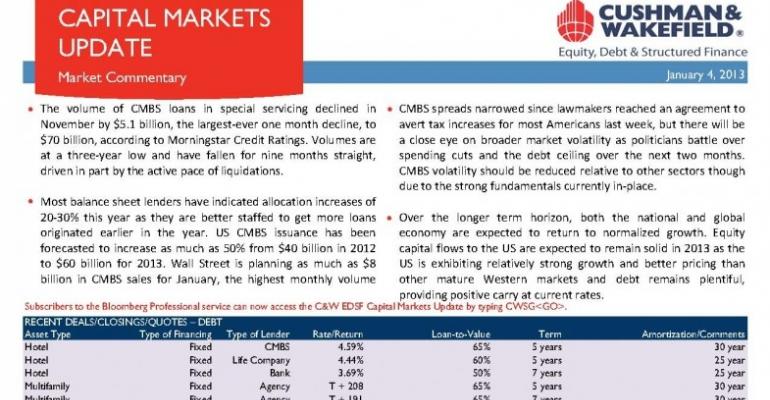

- The volume of CMBS loans in special servicing declined in November by $5.1 billion, the largest-ever one month decline, to $70 billion, according to Morningstar Credit Ratings. Volumes are at a three-year low and have fallen for nine months straight, driven in part by the active pace of liquidations.

- Most balance sheet lenders have indicated allocation increases of 20-30% this year as they are better staffed to get more loans originated earlier in the year. US CMBS issuance has been forecasted to increase as much as 50% from $42 billion in 2012 to $60 billion for 2013. Wall Street is planning as much as $8 billion in CMBS sales for January, the highest monthly volume since December 2007, according to Deutsche Bank AG.

- CMBS spreads narrowed since lawmakers reached an agreement to avert the fiscal cliff, but there will be a close eye on broader market volatility as politicians battle over spending cuts and the debt ceiling over the next two months. CMBS volatility should be reduced relative to other sectors though due to the strong fundamentals currently in-place.

- Over the longer term horizon, both the national and global economy are expected to return to normalized growth. Equity capital flows to the US are expected to remain solid in 2013 as the US is exhibiting relatively strong growth and better pricing than other mature Western markets and debt remains plentiful, providing positive carry at current rates.

- 10-year treasury yields increased in the second half of 2012 from a record low of 1.38% on July 25 to 1.97% on Friday morning. Part of the recent increase has been since it was released that the Fed may end the QE3 in 2013. Yields are forecasted to be 2.14% by the end of 2013 according to a Bloomberg survey.

0 comments

Hide comments