Just when it appeared that CMBS delinquencies might have been stabilizing, the delinquency rate leaped in April and is now back near its highest reading of all-time reached last July, according to Trepp LLC. The delinquency rate jumped 12 basis points in April to 9.80 percent.

If defeased loans were taken out of the equation, the overall delinquency rate would be 10.26 percent—up 14 basis points. The percentage of loans seriously delinquent (60+ days delinquent, in foreclosure, REO, or non-performing balloons) is at 9.41 percent--up 31 basis points.

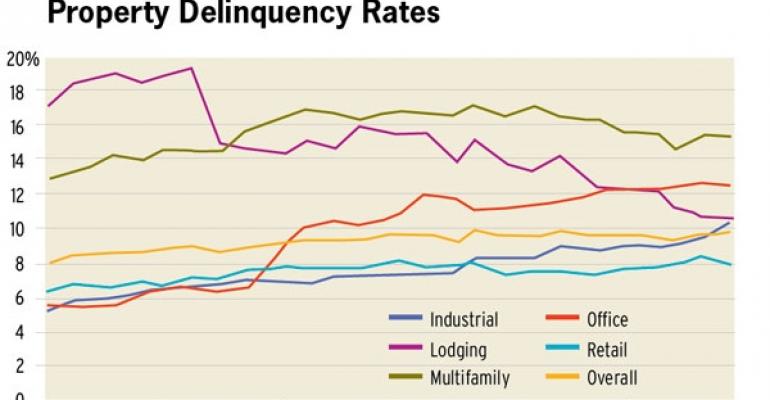

By property type, the office delinquency rate leaped 82 basis points to a new all-time high for the sector of 10.23 percent. Rates fell for the other major property types—down 21 basis points in the multifamily sector to 15.18 percent, down 26 basis points in the retail space to 7.98 percent, down 18 basis points in the industrial sector to 12.36 percent and down 8 basis points in the hotel sector to 10.55 percent.

There were $1.4 billion in liquidations in April—about nine percent higher than the moving 12-month average of $1.31 billion per month. However, the volume was up substantially from February and March. Overall, 148 CMBS conduit loans were liquidated in April, up from 95 in March.

The average loan size for liquidated loans was $9.7 million in April.

The losses from these liquidations were about $612 million--representing an average loss severity of 42.68 percent. This was up 10.91 percent from March's 31.77 percent reading. April loss severity is up 17.13 percent from February's 12-month low of 25.55 percent.