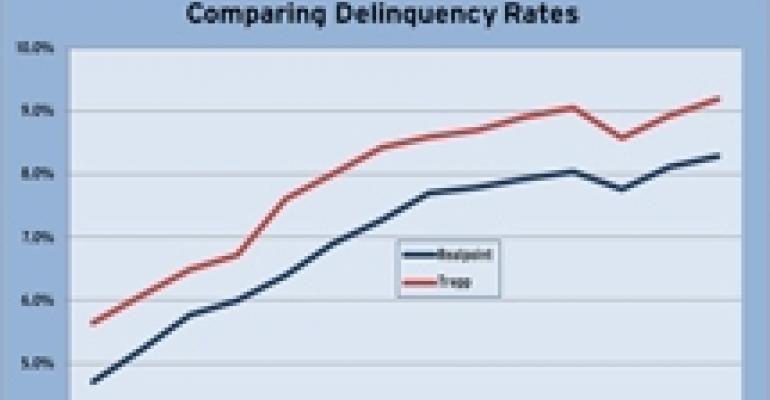

CMBS delinquency rates reached new highs in December, confirming that a brief improvement in October was an aberration, according to the two firms that track the sector.

As of the end of December, the CMBS delinquency rate stood at 8.29 percent according to Horsham, Pa.-based Realpoint LLC and at 9.20 percent according to New York-city based Trepp LLC. Both firms’ data had shown that the delinquency rate had fallen in October. But it then rose in both November and December and has now eclipsed the previous high point set in September 2010.

At the heart of the jump in both firm’s numbers was a marked increase in the delinquency rate on industrial properties. According to Realpoint, the industrial delinquency figure rose from 6.14 percent in November to 8.57 percent in December while Trepp said the figure jumped from 6.64 percent in November to 8.97 percent in December. The reason, according to Trepp, was that “two big loans” went delinquent during the month.

According Realpoint, the delinquent unpaid balance for CMBS rose $1.21 billion, up to $62.32 billion from $61.11 billion a month prior. The increase was below the pace of the first six months of 2010 when delinquencies grew by an average of $3.14 billion per month.

Each delinquency category increased in December 2010, fueled by further delinquency degradation and credit deterioration. According to Realpoint, “Despite ongoing loan liquidations, modifications and resolutions, the two most distressed categories of Foreclosure and REO grew by $577 million as a whole (2.5 percent) from the previous month and remain up by $14.73 billion (158 percent) in the past year (up from $9.34 billion in December 2009).”

The total unpaid balance for CMBS pools reviewed by Realpoint for the December remittance was $752.25 billion, up from $752.02 billion in November.

Inside the numbers

The delinquency ratio for December of 8.29 percent (up from the 8.13 percent reported for November) is almost two times the 5.20 percent reported in December 2009 and more than 29 times the Realpoint recorded low point of 0.28 percent in June 2007.

According to Realpoint, “The movement in both delinquent unpaid balance and percentage is now clearly being impacted by the size and amount of loan liquidations, modifications, extensions and resolutions reported on a monthly basis, leading to a potential slow-down in the reporting of new delinquency for the remainder of 2010 and 2011.”

By property type, in December, multifamily loans topped retail loans as the greatest contributor to overall CMBS delinquency for the seventh straight month. Retail loans had been the greatest contributor for six straight months prior to June. Delinquent multifamily loans account for 2.23 percent of the CMBS universe and 27.0 percent of total delinquency.

Hotels, meanwhile, had the highest delinquency rate—13.83 percent, although the figure has been improving in recent months. The retail default rate increased slightly to 7.38 percent, up from 7.15 percent in November and up from 4.8 percent one year ago.

In its monthly report, Realpoint wrote, “Despite a leveling off over the past five months, we still consider retail delinquency a legitimate concern for 2011. A prolonged economic recovery could have further impact on consumer spending and cause retailers to continue to struggle. We also cannot rule out additional store consolidation, closings and potential bankruptcies along with growing balloon maturity default risk as retail collateral continues to suffer from the experienced decline”

Trepp's view

Meanwhile, in its analysis, New York City-based Trepp said that the CMBS delinquency rate rose to 9.20 percent in December up from 8.93 percent in November. The rate topped the previous high of 9.05 percent set in September 2010.

According to Trepp, “Many have speculated that between the emergence of new CMBS lending, the resolution of many troubled CMBS loans, and an uptick in trophy property sales, that the commercial real estate crisis was nearing its final stages. The December delinquency rate of 9.20 percent, the highest in history for U.S. commercial real estate loans in CMBS, underscored that there still may be some nasty surprises in store even as the market shows some signs of healing. In October, the market had seen its first decline in the delinquency rate in well over a year. Unfortunately, that decline now appears to have simply been a blip. … This December jump comes despite the fact that new issues continued to make their way into the calculation and servicers continued to resolve troubled loans. The new deals - which theoretically should have low delinquencies for a while - will continue to put downward pressure on the delinquency rate as issuance continues to grow in 2011. Similarly, the resolution of troubled loans will also help to lower the rate.”

The delinquency rate one year ago was 5.65 percent. The 30+ day delinquency rate on retail rose to 7.59 percent from 7.17 percent in October.

Multifamily surpassed lodging as the sector with the highest delinquency rate. The multifamily rate is at 15.80 percent (up from 14.63 percent in October) while the lodging delinquency rate fell to 14.56 percent from 14.92 percent in October. The lodging delinquency rate peaked at 19.33 percent in September. The delinquency rate for industrial properties fell from 6.27 percent to 6.64 percent. It rose for office properties from 6.68 percent to 6.95 percent.