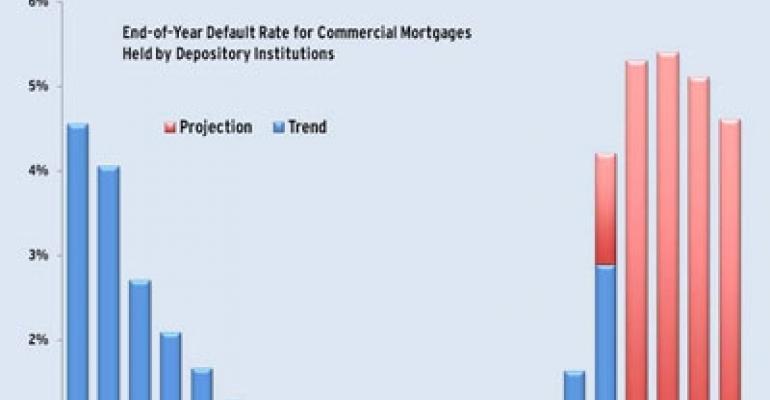

New projections from Real Estate Econometrics LLC predict that the default rate on commercial mortgages held by U.S. banks will hit a peak of 5.4 percent in 2011, the highest level since 1992, when the default rate hit 4.6 percent. The 5.4 percent figure is nearly double the 2.9 percent default rate banks posted at the end of the second quarter, according to FDIC data analyzed by the research firm.

The firm increased its projected default rate from earlier this year because fundamentals have continued to erode for all commercial property types. Overall, Real Estate Econometrics expects defaults to reach 4.2 percent by the end of 2009 and hit 5.3 percent in 2010 before peaking in 2011. Earlier in the year the company projected that the default rate would peak at 4.8 percent in 2001. However, the firm expects a gradual recovery in the default rate in 2012 and 2013.

The default rate of 2.9 percent in the second quarter is more than double the rate posted in the second quarter of 2008. Loans that were 90 days or more past due amounted to just 1.18 percent of outstanding balances last year.