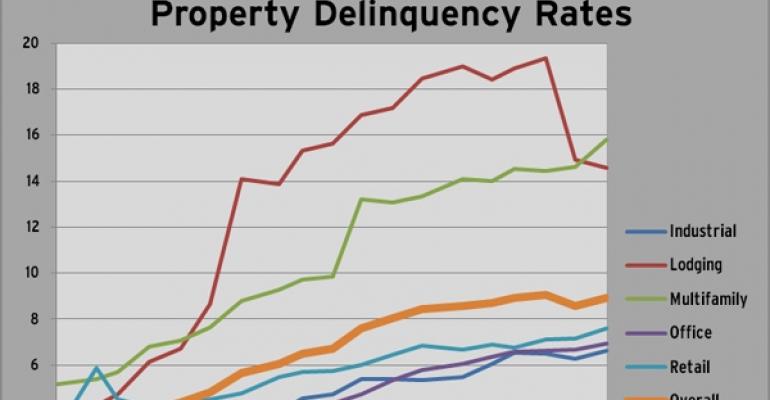

- The overall delinquency rate in November jumped 35 basis points—the largest increase since May 2010.

- The resultant percentage of loans 30+ days delinquent, in foreclosure or REO is at 8.93 percent, the second highest level after September’s 9.05 percent.

- Overall, 8.13 percent of loans are seriously delinquent (60+ days or more past due), up from 7.55 percent six months ago and 4.29 percent one year ago.

- Multifamily surpassed lodging as the sector with the highest delinquency rate. The multifamily rate is at 15.80 percent (up from 14.63 percent in October) while the lodging delinquency rate fell to 14.56 percent from 14.92 percent in October. The lodging delinquency rate peaked at 19.33 percent in September. The delinquency rate for industrial properties fell from 6.27 percent to 6.64 percent. It rose for office properties from 6.68 percent to 6.95 percent.

- The dip in October delinquency was due to the resolution of the Extended Stay Hotels loan, which accounted for 50 basis points in the delinquency calculation. Similarly, once the Stuyvesant Town loan is resolved, it will account for another 40 basis point improvement.

Source: Trepp LLC

0 comments

Hide comments