The Mortgage Bankers Association’s Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations showed that the volume of retail loans rose in the fourth quarter and nearly matched the quarterly average the industry posted in 2001.

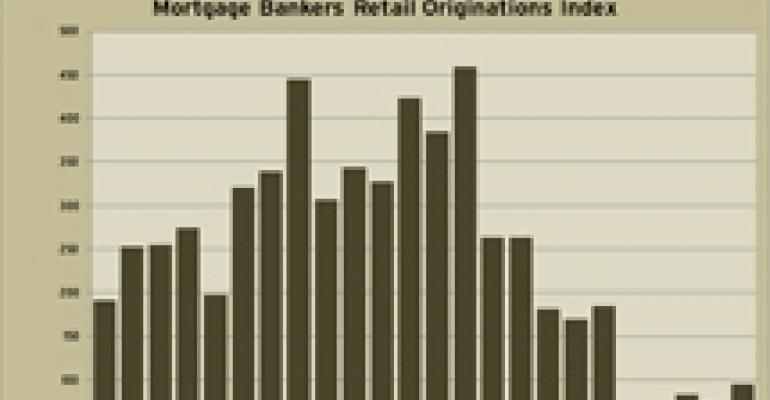

For all property types, the MBA’s originations index reached 61—up slightly from the 53 it posted in the third quarter and the highest quarterly reading the association has measured since the third quarter of 2008. The mark slightly edged out the reading of 60 posted in the second quarter. However, the index remains far from its historic norms. It was the fifth straight quarter with a reading below 61 and the volume in the last five quarters has been the lowest posted going back to at least 2001. (A reading of 100 equates to the volume of an average quarter in 2001.)

The picture was a bit brighter for retail properties. The MBA’s origination index on retail hit 95 in the quarter—up from a reading of 71 in the third quarter and more than double the readings of 43 and 47 posted in the first quarter of 2009 and the fourth quarter of 2008. The index for retail properties was at 185 during the third quarter of 2008.

The origination index for the sector was the closest to 100 of the five major commercial property types--multifamily, office, retail, industrial and hotels. Office had the lowest reading with the originations index at 29 for that sector. The next highest after retail was the multifamily sector where the index came in at 77 during the quarter. Health care properties, however, had the highest reading with the index at 289 for the quarter.

As for loan sizes, the average retail deal came in at $13.6 million. That was down from $16.7 million in the third quarter, but almost double than the $7.5 million average posted in the fourth quarter of 2008.

“Commercial and multifamily mortgage originations picked up in the fourth quarter, but remain at a low level in absolute terms,” said Jamie Woodwell, MBA vice president of commercial real estate research in the MBA’s report. “The trend shows stability coming back to the market, but the pick-up in volumes really indicates just how low origination levels had fallen.”

According to the report:

The 12 percent overall increase in commercial/multifamily lending activity during the fourth quarter was driven by increases in originations for all property types except multifamily. When compared to the fourth quarter of 2008, the increase included a 105 percent increase in loans for hotel properties, a 101 percent increase in loans for retail properties, a 59 percent increase in loans for industrial properties, a four percent increase in loans for office properties, a one percent increase in health care property loans, and an eight percent decrease in multifamily property loans.

Among investor types, loans for life insurance companies saw an increase of 112 percent compared to last year’s fourth quarter. There was also a 17 percent increase in loans for commercial bank portfolios, an 82 percent decrease in loans for conduits for CMBS, and the dollar volume of loans for Government Sponsored Enterprises (or GSEs – Fannie Mae and Freddie Mac) saw a decrease of 26 percent.