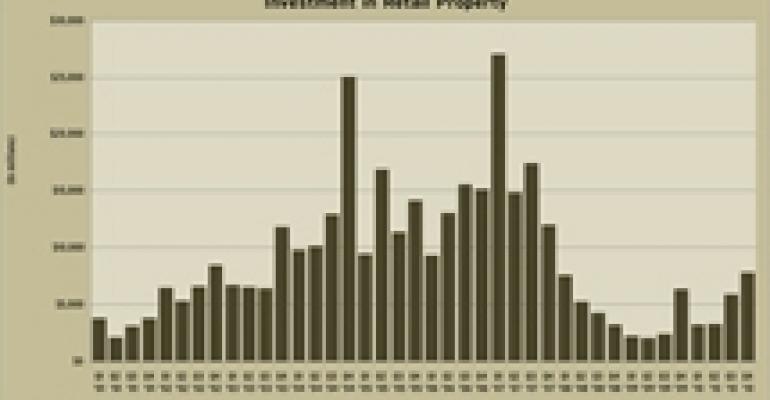

New data from New York City-based Real Capital Analytics (RCA) shows that retail investment sales volume reached its highest point since this down cycle began. During the fourth quarter, 494 significant retail properties changed hands in transactions worth a combined $7.8 billion. (RCA counts transactions larger than $5 million.)

Volume in the quarter was up more than $2 billion from the third quarter. It was the busiest quarter for retail investment sales since the fourth quarter of 2007 when $12.0 billion in property changed hands.

The big quarter put volume for the year at $20.21 billion, an increase of more than $7 billion compared to the $13.05 billion in deals in 2009 and just below the $20.35 billion in deals that took place in 2008. The volume is just a fraction of the industry’s volume in 2007, when a whopping $71.3 billion in significant retail transactions took place.

The average cap rate on retail properties came in at 7.9 percent—matching the figure in 2009 and up 100 basis points from the average figure in 2008. The average price paid per square foot worked out to $158 in 2010—$12 greater than the average price paid in 2009.

By sub-sector, the volume works out to $12.26 billion in shopping center transactions and $7.95 billion in regional mall deals. Average cap rates were 8.2 percent on shopping centers and 7.6 percent on regional malls. And average prices were $149 per square foot for shopping centers and $171 per square foot for regional malls.

There appears to be some continued room for cap rate compression—perhaps making it a good time for investors to buy.

According to RCA’s commentary, “With retail cap rates holding at higher levels than offices or apartments, spreads remain exaggerated by historical standards. The positive leverage between cap rates and retail mortgage interest rates is presently 171 basis points, more than double the 85 basis points average for the decade and almost three times the 63 basis point spread at the market’s investment peak. Risk spreads remain elevated as well, holding at 450 basis points even as Treasury rates have spiked and the economic outlook has improved.”