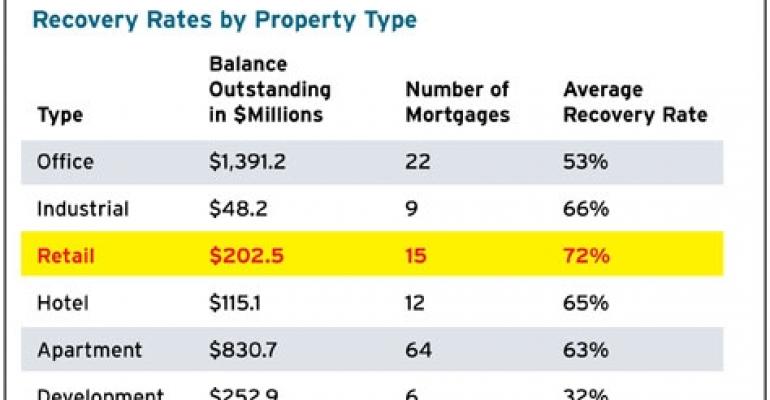

Real Capital Analytics recently released a report that highlights recovery rates on defaulted commercial mortgages to date in 2009. Despite the retail industry’s poor health and the fact that retail properties have among the highest default rates, retail led all commercial property sectors with a 72 percent recovery rate, representing $202.5 million in loans, or 15 total transactions. According to the report, recovery rates are influenced by market fundamentals as well as a lender’s motivation to liquidate certain loans. Broken down by type, strip centers experienced a 70 percent recovery rate while malls and other retail properties achieved a recovery rate of 75 percent.

Loans are considered resolved, or liquidated when the note or property is sold to a third party buyer. However, the recovery rate does not include deals in which there was seller financing. In addition, the recovery rate only takes into account the total amount of the loan resolved and does not incorporate other fees and costs incurred by a lender to resolve a non-performing loan.