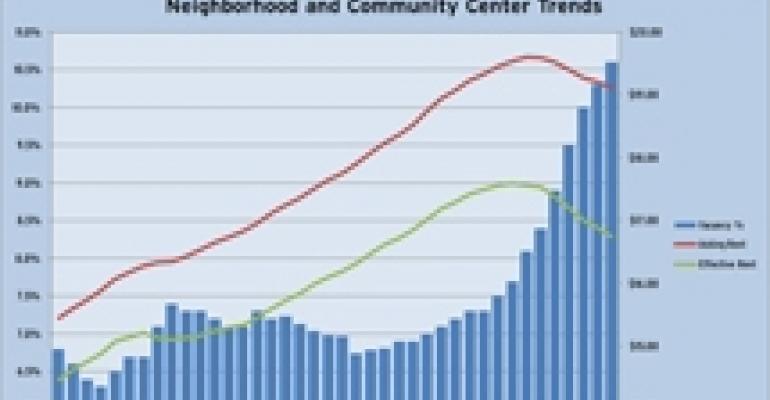

Real estate research firm Reis Inc.’s data for the fourth quarter of 2009 shows continued erosion in fundamentals at neighborhood and community centers and regional malls. Vacancies at both property types rose. For shopping centers, vacancies are at their highest point since 1991 and for regional malls vacancies are at their highest point since Reis began tracking the figure at the end of 1999.

The conditions have caused rents to fall to the point where asking and effective rents at neighborhood and community centers are now back to the levels they were in 2006 and 2007. Asking rents at regional malls have also dropped to 2006 levels. According to Reis, “This is also the first time in our 10 year history for regional malls that we’ve observed four straight quarters of asking rent declines, and the year-over-year decline of negative 3.6 percent is the largest magnitude of deterioration over a 12 month period on record as well.” More troubling, this is the first time in the 29 years it has been tracking neighborhood and community center trends that Reis has recorded effective rent drops in all 77 markets it covers.

The numbers also indicate that community and shopping centers have had negative absorption for eight straight quarters, but the losses were much greater in 2009 than in 2008. Cumulatively, neighborhood and shopping centers have experienced negative absorption of 30.4 million square feet in the last eight quarters. Of that, 24.1 million square feet came off the books in 2009. The only bright spot in the data is that the losses were worse in the first half of 2009 (-15.7 million square feet) than the second (-8.4 million square feet). In fact, the pace of negative absorption has fallen for three straight quarters, indicating that perhaps a bottom is near.

Reis cautions, however, “[N]ote how completions have also slowed, with 1.8 million square feet of strip mall space coming online this period. Also note how negative net absorption outstripped the amount of newly completed space for every quarter in 2009.”

Overall, the sector added 10.1 million square feet in new space in 2009—down from more than 25 million square feet in 2008 and 33.3 million square feet in 2007.

Going forward, Reis expects economic pressures to continue to affect consumers and businesses. Although the economy is growing again, high unemployment and inconsistent consumer spending patterns make for a difficult outlook for retail properties for another 18 to 24 months.

“Reis continues to project increasing vacancy levels and negative asking and effective rent growth for neighborhood and community centers through 2011. We have yet to observe any unexpected systematic resumption in hiring and strength in consumer spending that may lead us to revise our projections with a more optimistic bent,” the company wrote in its report.