Rexford Industrial, a privately held industrial property investment firm based in Los Angeles, has launched its fifth investment vehicle, Rexford Industrial Fund V Real Estate Investment Trust. Structured as a private REIT, the fund began operating during the fourth quarter of 2010 with four acquisitions, including two industrial property purchases and two discounted note purchases tied to industrial property. All the properties are infill locations in Los Angeles and Orange counties.

Through its proprietary industrial funds, including Rexford Industrial Fund V, Rexford is positioned to acquire more than $500 million of industrial properties throughout Southern California. Rexford owns and operates more than 5.5 million sq. ft. of industrial properties throughout Los Angeles, Orange and San Diego counties.

Rexford Industrial is penetrating the highly fragmented industrial market in Southern California with a focus on small to medium-sized properties. “Rexford’s recent purchases represent the substantial pipeline of stressed and distressed acquisition opportunities that we are actively pursuing,” says Michael Frankel, Rexford’s managing partner.

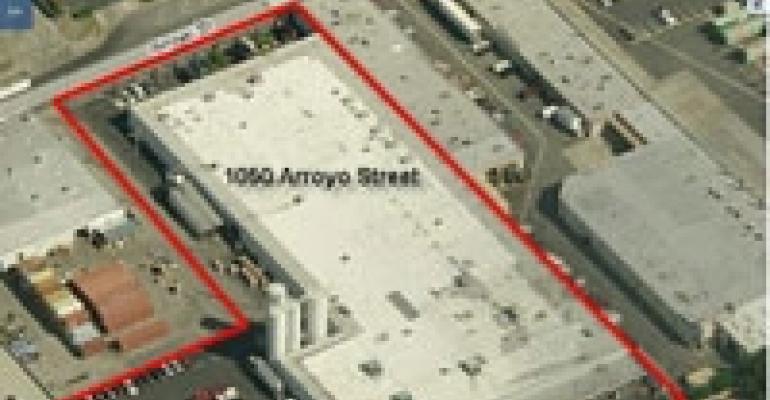

Rexford Industrial Fund V has made four investments, including the acquisition of a 78,000 sq. ft. light manufacturing building at 1050 Arroyo Street in San Fernando, Calif. The property, which features above-standard parking, high-quality interior improvements, and is suitable for single- or two-tenant usage, was purchased for approximately $3.4 million, or $43 per sq ft. Rexford is in advanced negotiations with a tenant to lease the entire building.

“We have pursued this property for nearly 10 months and were able to purchase the building at a substantial reduction from its original listing price and at a substantial discount to replacement cost,” says Frankel. Rexford’s ability to close on an all-cash basis with speed and certainty helped seal the deal.

The company has also acquired Grand Commerce Center. The 101,187 sq. ft. multi-tenant industrial complex located at 600 South Grand Avenue in Santa Ana, Calif., sold for $7.8 million, or $77 per sq. ft. Rexford purchased the 80% leased property in a lender short sale, and the investment represents a substantial opportunity for Rexford to add value by professionally managing the project. Rexford estimates that it purchased the property at approximately 50% below replacement cost.

“These acquisitions are consistent with our goal to work with distressed sellers to acquire industrial properties in high-barrier, Southern California infill industrial markets where we can add value,” says Howard Schwimmer, co-founder and senior managing partner at Rexford.

Rexford Industrial Fund V also has purchased the underlying mortgage loans on Calle Perfecto Business Park in San Juan Capistrano, Calif., and Pasadena Foothill Center in Pasadena, Calif. The loans were purchased on an all-cash basis and closed in 10 days. Terms of the loan purchases were not disclosed.

Calle Perfecto Business Park is a 99,500 sq. ft., five-building light industrial complex that is 92% leased. Built in 2000, the property fronts Interstate 5 and features 24-foot clear height ceilings. Pasadena Foothill Center is located in the East Pasadena submarket, and is a five-building, 55,100 sq. ft. light industrial/flex project that was built in 1957.

Frankel describes Rexford’s strategy as a win-win situation. “These note purchases demonstrate Rexford’s ability to make attractive investments tied to well-located industrial property through a range of deal structures representing solutions for lenders or distressed owners.”