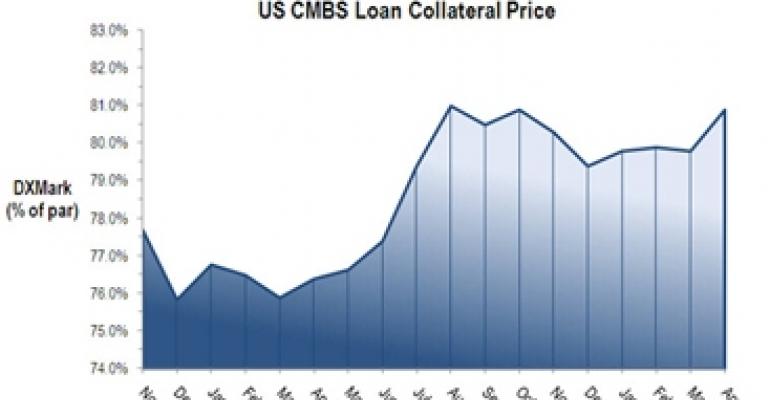

The aggregate value of securitized loans priced by DebtX at the end of April registered 80.9% of par value, up from 79.8% a month earlier and 76.4% a year ago.

“Declining Treasury yields coupled with strong demand for performing loans on the secondary market had a positive impact on commercial real estate loan prices,” says Kingsley Greenland, CEO of Boston-based DebtX, which provides an online marketplace for loan sales.

Indeed, the 10-year Treasury yield declined to 3.32% on April 29, down from a recent peak of 3.75% reached on Feb. 8. By May 24, the 10-year yield had fallen even further to 3.12%.

Because bond yields move inversely to bond prices, the declining 10-year Treasury yield has elevated the value of loans held in CMBS trusts.

In April, DebtX priced 53,271 commercial real estate loans with a $653.2 billion aggregate principal balance. The loans collateralized 627 U.S. CMBS trusts.