For the first time, shopping centers have an individualized way to benchmark energy use, thanks to the new Property Efficiency Scorecard, which is being launched today at ICSC's Retail Green conference in Phoenix.

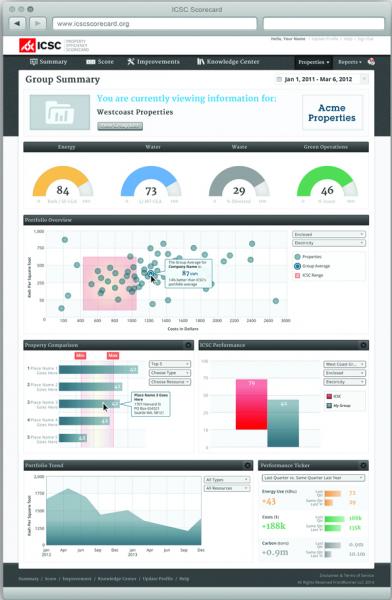

The scorecard will allow property owners to input data online on energy use, water consumption, recycling and waste and overall green operating practices. Enter data from one center—or all of the centers in your portfolio—and you can compare it with others in your portfolio or to centers with similar characteristics.

The scorecard will allow property owners to input data online on energy use, water consumption, recycling and waste and overall green operating practices. Enter data from one center—or all of the centers in your portfolio—and you can compare it with others in your portfolio or to centers with similar characteristics.

Eventually, the goal is for the Scorecard to have ranking similar to an Energy Star 0 to 100 rating, says Will Teichman, director of sustainability for Kimco Realty, one of the partners that helped craft the tool. For now, in each category, property owners can receive a score that is similar to the energy-use intensity (EUI) score, which measures kilowatt use per sq. ft. per year.

The program will offer basic suggestions on how to save energy, based on the benchmarking results, but the real work comes after benchmarking.

“What it does is give you insight that allows you to dig deeper,” says Teichman, who adds that he expects all of Kimco’s retail properties to be benchmarking with the program by January.

Benchmarking is important because property owners can’t start saving money on energy unless they know how much they are using, he explains; however, benchmarking also has tangible benefits that extend well beyond energy efficiency.

“Although some argue this may correlate to higher rents over the long term, we view it as more of a competitiveness issue,” says Teichman. “Sustainability is an expectation of leading retailers and the implementation of these measures lowers one of our tenants’ largest occupancy costs.”

Sustainability is also becoming an increasingly important priority to investors, Teichman says. “Particularly with large institutional shareholders—they are requesting greater transparency into the sustainability performance of real estate portfolios, and view sustainability as an opportunity to improve property performance and mitigate risks,” he says. “Growth in disclosure forums such as the Global Real Estate Sustainability Benchmark (GRESB) is a leading indicator of investor interest in sustainability.”

The information on each center is not public, so property owners need to know how their buildings stack up against centers in similar geographic areas, says Rudolph E. Milian, ICSC’s senior staff vice president for professional development services. Enrollment begins in January. “We definitely want to have at least 1,000 properties in the system in 2014, and I think we can exceed that,” Milian says.

Payment is based on the number of properties benchmarked: one to 10 properties costs $400 per property annually, and 51 to 100 centers costs $255 per property per year. The fee for benchmarking more than 101 properties is a flat $30,000 fee annually.

Joyce Mihalik, vice president of energy services for Forest City Enterprises, is another one of the Scorecard’s early adopters and creators. About 75 percent of Forest City’s retail portfolio is already entered into the Scorecard system. She says her company has an internal benchmarking tool used for its properties, and she expects to use the ICSC Scorecard in a similar way.

“We use it as a prioritization tool, for budget and forecasting purposes, where to do upgrades and interventions,” Mihalik says. “This is the way we know that here is a property where we have to go back and spend the day with the property manager to see what is really happening out there.

“Are they really a poor performer? Or was the system on over-ride for three months because that tenant needed extra hours?” she says. “The data is only half the story. Then you have to do the homework.”

It is crucial for the shopping center sector to have its own benchmarking metric because that property type is so different from the rest of the commercial real estate sector, Mihalik says. While Energy Star and Portfolio Manager are widely known and well regarded, she adds, they don’t take into account the unique nature of the shopping center market.

Although Mihalik says Energy Star has an important place, she notes that one of the frequent criticisms of the Portfolio Manager program in the fact that the data used for comparing commercial properties is from 2003. “This Scorecard is going to allow you to compare yourself to a live dataset,” she says.

Energy Star has come under criticism from the multifamily sector for not having a rating designed for the quirks of that sector, and a score targeted for multifamily is expected in 2014. No other commercial real estate sector has created its own benchmarking system like the ICSC Scorecard.

The Scorecard also allows users to upload data only once and then to export it into other formats, such as Portfolio Manager or GRESB, in order to meet local laws or requests from tenants or investors. “I don’t want to have to key in my data a hundred times in different places,” Mihalik says. “I’d rather have our energy-efficiency team being sent out to do an energy audit or develop sustainable policy.”

Mihalik says she doesn’t see ICSC’s Scorecard as being “in competition with other reporting standards.” Instead, she says she appreciates it as “an added feature and an added tool.”