Job growth nationally will be “non-existent” until the second half of 2010, followed by a gradual but weak recovery, predicts Georgia State University economist Dr. Rajeev Dhawan, who adds that a lack of business investment is at the root of the employment crisis.

Meanwhile, the fallout from the meltdown of the financial system last September punctuated by the collapse of Lehman Brothers is not over, warns Dhawan. The $64,000 question is how the toxic, or underperforming, assets on the balance sheets of banks are going to be cleaned up. “That is the key. Everything else is a supporting character, a supporting cast. The solution is not easy.”

The gloomy forecast delivered by Dhawan to about 50 members of GSU’s Department of Real Estate Honorary Board last Thursday morning at The Commerce Club in downtown Atlanta did sprout at least one green shoot.

The veteran economist estimates that real GDP rose 3% on an annualized basis in the third quarter of 2009. But such prosperity appears short-lived. Dhawan is forecasting fourth-quarter GDP to rise a paltry 0.9%, and then climb to only 1.4% in the first quarter of 2010.

Retrenchment mode

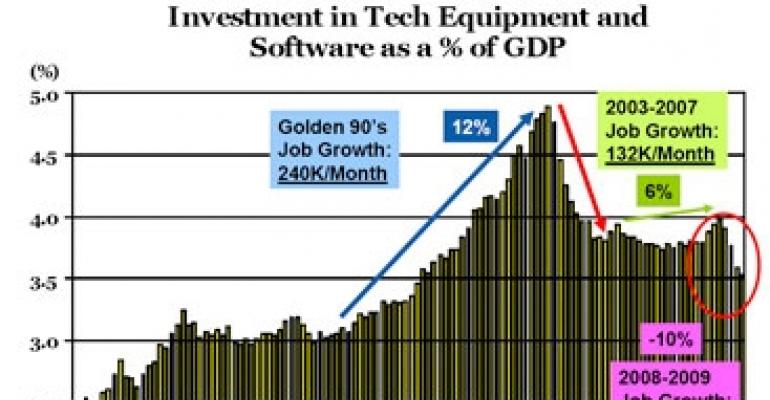

A look at business investment trends over the past 20 years offers some insight into why the labor market is currently stumbling. For much of the 1990s, investment in technology equipment and software expressed as a percentage of U.S. GDP posted a compound annual growth rate of 12%, according to Dhawan. Job growth during those golden years averaged 240,000 per month.

Between 2003 and 2007, investment in tech equipment and software as a percentage of GDP moderated somewhat, posting an annual compound growth rate of 6%. The pace of job creation also moderated to 132,000 per month during that period.

During the past 18 months, business activity has slowed dramatically. Tech investment as a percentage of GDP has contracted at a compound annual rate of 10%. The U.S. economy has shed an average of 360,000 jobs per month during that stretch.

For Dhawan, the ramifications of this decline in business investment are quite clear. “If the corporate sector does not come back into the game with the investment, there will be no job growth.”

What propels the corporate sector to invest again? “Apart from the financing, it’s the mood of the CEOs,” emphasizes Dhawan. In other words, not until executives feel comfortable launching new divisions or entering new markets are they going to be compelled to hire more workers. “When CEOs get optimistic, about six months later they start opening their wallets, they start doing investment, and they start hiring people,” says Dhawan.

But a lack of revenue growth is curbing CEOs’ appetite for expansion at the moment. Publicly traded companies included in the Dow 30 on average boosted revenues by more than 10% during the first half of 2008. This year, however, is a completely different story. In the second quarter, revenue declines among Dow 30 companies averaged nearly 17% on a year-over-year basis.

“When you have a 25% turnaround in your revenue projections in six to nine months, you do not feel like opening up your wallet to new investment. No amount of sweet-talking will do it,” says Dhawan.

Atlanta ailing along with America

Since peaking in September 2007, Georgia’s total non-farm payroll employment declined by 287,300 through August of this year, a drop of 7.3%, according to GSU’s Economic Forecasting Center. Georgia’s unemployment rate was an unhealthy 10.2% in August, the most recent figure available. The state’s unemployment rate will reach 11% by mid-2010, forecasts Dhawan.

Meanwhile, Metro Atlanta’s unemployment rate in August stood at 10.4%. Both the local and state jobless figures are worse than the national unemployment rate, which reached 9.8% in September, up one-tenth of a percent from August.

The severity of the recession in Georgia stems not only from corporate job losses tied to the onset of last fall’s financial crisis, but also from the severe drop in residential building activity that has occurred over the last year and a half.

The number of housing starts in Metro Atlanta totaled 6,000 in the second quarter, down more than 90% from the boom years of 2001 through 2006 when residential construction was at a fever pitch.

The weakened state of the economy and the plight of the consumer have taken a huge bite out of state tax revenues. Total tax collections in Georgia fell 19.3% and 17.1%, respectively, in the third and fourth quarters of fiscal year 2009 on a year-over-year basis. The state’s fiscal year runs from July 1 to June 30.

Dhawan projects that Georgia’s total tax collections will fall 12.7% in the first quarter of fiscal 2010. If that forecast holds, it would mark the seventh straight quarter of declining tax collections on a year-over-year basis.

Why aren’t banks lending?

The excess reserves of depository institutions nationally totaled nearly $800 billion in August 2009, compared with less than $100 billion in September 2008. That’s a lot of dry powder, a big chunk of which would be put into play in a more stable lending environment.

But that’s hardly the case today given the volume of troubled loans in both the commercial and residential sectors. In effect, this mountain of capital acts as a form of safety reserves to offset a possible overhang of impaired debt on the balance sheet.

Many community and regional banks with a large exposure to commercial real estate realize that they could be forced to take write-downs on troubled loans at some future point. Consequently, they’re squirreling away cash collected from incoming deposits and not making any loans. “That’s called cleaning the balance sheet, or deleveraging,” says Dhawan.

But what’s the strategy of the healthier banks? “The good banks are holding onto the cash. They are waiting to pounce on the [distressed] assets whenever they come on the market,” says Dhawan. “They are squirreling the cash to go for this big feeding. And in between they are not going to make the loans. They want to keep the balance sheets totally clean.”