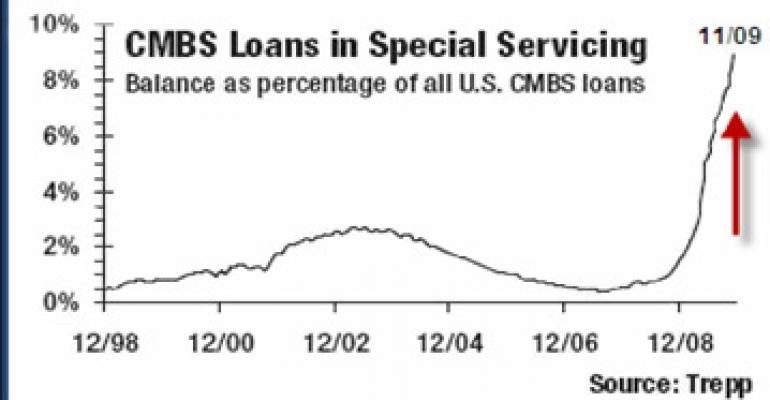

After months of waiting, opportunity investors are finally getting a break. Over the past 12 months, defaults on CMBS loans have jumped from less than 1% to nearly 9%. Overwhelmed with the sheer number of troubled securitized loans falling into their laps, many special servicers are opting to sell or liquidate the notes and underlying properties rather than work with borrowers to keep distressed loans alive.

“When it comes to the investor community, we’re hearing there’s more and more meaningful engagement with special servicers as they continue to get overwhelmed and are clearly electing sale/liquidation strategies,” commented Dave Warmund, a vice president for Trepp LLC, during a webinar titled “Distressed CRE Debt: Where are the Opportunities?” The presentation was delivered to an audience of investors and media on Tuesday.

Trepp bases its research on mortgage and property performance of more than 80,000 CMBS loans representing approximately 100,000 properties with an outstanding balance of more than $800 billion. The New York-based provider of CMBS and commercial mortgage information was selected by the Federal Reserve Bank of New York as a collateral monitor for CMBS as part of the Term Asset-Backed Securities Loan Facility (TALF) in June.

To dispose of troubled loans, special servicers now favor liquidation strategies that include foreclosure, bankruptcy, REO, deed in lieu of foreclosure and note sales. Over the past 60 days, there has been an 18.3% increase in such strategies, representing 1,387 loans, up from 1,172.

Meanwhile, over the same period strategies that focus on working with borrowers to cure distressed loans, including modification, resolution, extension and discounted payoff have increased by only 4.9% to 812 loans, up from 774.

To identify where future loans in distress will originate, Warmund advises investors to look at the underlying debt-service coverage of loans as well as net operating income (NOI).

“Regardless of whether loans are performing or not, there are 9,000 to 10,000 loans that have debt-service coverage under 1.0, or marginal coverage, many of which are not yet delinquent,” Warmund explains. Moreover, there are almost 4,800 loans backed by assets with deteriorating NOI that have experienced 20% to 50% decreases in cash flow. “This represents a large pool of loans that will provide opportunity for distressed asset buyers,” he says.

Prospective buyers of distressed assets also will benefit as the dollar volume of loans that are experiencing changes in credit quality continues to grow, according to Trepp. In November, for instance, $15.6 billion worth of CMBS loans were categorized as having deteriorating delinquencies, and another $14.8 billion were placed on a watch list. At the same time, some $9.1 billion in loans were sent to special servicing and another $3.4 billion had appraisal reductions.

By property type, the greatest likelihood of opportunity for distressed buying can be found in the hotel and multifamily sectors. At the end of November, 17.3% of all CMBS-backed hotels and 13% of multifamily properties were in special servicing. In contrast, just 4.9% of office properties backed by CMBS loans had been turned over to special servicing, although that sector makes up 30.2% of all CMBS loans.

Over the past two months, the Mountain region has recorded the biggest rise in the delinquency rate (10.4%), followed by the East South Central region (7.2%) and the West South Central region (6.6%).

Despite the distressed asset concentrations in specific regions or markets, trouble knows no geographic boundaries. “Because of the granularity of the data at the loan and property level,” Warmund notes, “there are likely opportunities in virtually any market.”