The retail investment sales sector has gotten off to a robust start in 2012 with Westfield’s announcement of its joint venture with the Canada Pension Plan Investment Board. But don’t expect a slew of high-quality portfolio sales to follow during the rest of the year. While overall volume of sales might overtake 2011, the recovery in the retail sector will continue to be marked by caution and slow progress.

So far, investment sales activity on retail properties has gotten to a decent start, with $1.96 billion in closed sales and $8.16 billion in pending transactions quarter-to-date, according to Real Capital Analytics (RCA), a New York City-based research firm. Combined, the figure would put sales volume in the first quarter slightly above the volume recorded in the fourth quarter of 2011 at $10.6 billion.

Cross-border investors and publicly traded REITs accounted for most of the activity in 2012, with 39 percent and 33 percent of deal volume respectively, RCA reports. Most of the cross-border acquisitions were made by Canadians, who picked up 13 properties totaling approximately $2.2 billion (not counting the Westfield/CPPIB deal). Private buyers accounted for 12 percent of sales, and institutional investors for 11 percent.

What’s more, recorded deal terms reflect investors’ growing appetite for retail properties. Quarter-to-date cap rates on retail sales have averaged 6.7 percent, 80 basis points below the average cap rate for the fourth quarter of 2011. Average price per sq. ft. went up more than $20, to $213 from $190.

“This is the busiest we’ve been at the start of the year since 2008,” says Kris Cooper, managing director of retail capital markets with Jones Lang LaSalle, a real estate services firm. “Normally, we don’t start getting a lot of requests for broker opinion of value until later. We’ve received probably double or triple the volume this year over the past two years. I view that as a good sign.”

Core values

Yet investors continue to gravitate toward core assets in primary markets, and are willing to take only limited risk on centers located in secondary cities. Class-C assets and properties in tertiary markets continue to be out of play.

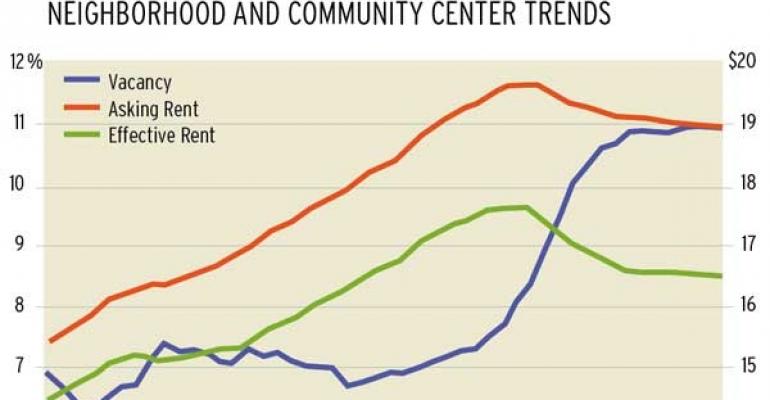

Part of their risk aversion can be attributed to the fact that sector fundamentals have barely budged over the past several quarters. At year-end 2011, the national vacancy rate for neighborhood and community shopping centers stood at 11 percent, equal to the vacancy rate at the end of 2010. Effective rents were at $16.51 per sq. ft., the same as two years prior, according to Reis Inc., a New York City-based research firm.

Vacancy at regional malls has dropped 20 basis points during the same period, to 5.7 percent, but quoted rents went down 2.8 percent, to $19.22 per sq. ft. from $19.79 per sq. ft. in the fourth quarter of 2010, reports the CoStar Group, a Washington, D.C.-based research firm. What’s more, because of regional malls’ size, there are few investors outside the major REITs who can afford to buy them, so the vast majority of prospective buyers have been concentrating on grocery-anchored shopping centers, which typically trade for under $50 million, says John Pelusi, executive managing director in the Pittsburgh office of HFF, a commercial real estate capital intermediary.

Last year the biggest increase in sales volume in the retail sector involved properties priced between $10 million and $20 million, according to Marcus & Millichap Real Estate Investment Services, an Encino, Calif.-based brokerage firm. Trades on those assets rose 98 percent compared to 2010.

Given the uncertainty associated with the upcoming election and the ongoing financial problems in Europe, it seems unlikely that retail investors will significantly widen their acquisition criteria in the near future. Marcus & Millichap predicts 2.1 percent GDP growth for the U.S. in 2012 and potentially, a mild Eurozone recession. The firm expects that effective retail rents nationwide will rise only 1.2 percent over the coming year, with most of the growth occurring in gateway markets.

In fact, pricing on class-A assets in primary markets will likely reach a new peak this year, according to Marcus & Millichap. The firm ranks San Francisco; San Jose, Calif. and Seattle as the top three cities on its National Retail Index for 2012, based on supply and demand conditions.

“I would say that the activity level for 2012 will be equal to or greater than what we saw in 2011, and it will be more of the same—any core or core-plus offering in a major market will be aggressively sought by the REITs, the pension funds, institutional equity and private equity,” says Pelusi.