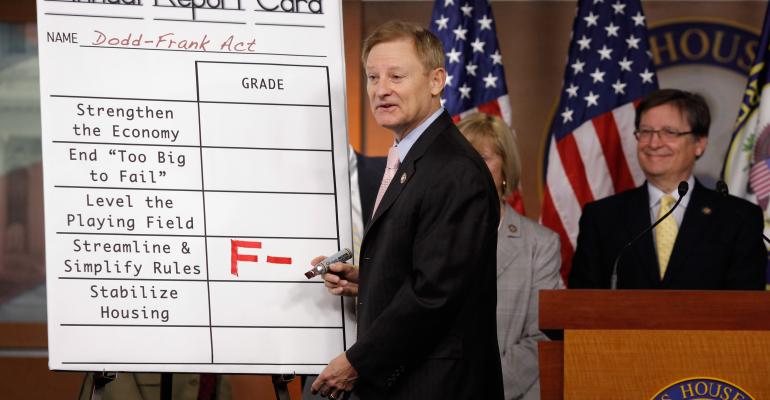

Republicans are hoping that version 2.0 of the Financial CHOICE Act will be the silver bullet that repeals many of the more stringent financial reforms put in place in the wake of the 2008 financial crisis. But that may be wishful thinking. Even with a majority in Congress, the legislation faces a tough battle ahead.

The comprehensive financial reform bill is about 600 pages and tackles a number of contentious issues ranging from the leadership structure of key agencies to specific banking regulations. The legislation is credited to House Financial Services Committee Chairman Rep. Jeb Hensarling (R-Texas) who also introduced a similar bill (version 1.0) last year.

“It is far more likely that we will see a version 3.0 than we are to see this pass without significant changes or amendments,” says Sam Chandan, Ph.D., an associate dean at the NYU School of Professional Studies Schack Institute of Real Estate.

As its size suggests, the Financial CHOICE Act is “incredibly ambitious,” notes Bill Killmer, senior vice president for legislative and political affairs at the Mortgages Bankers Association. One of the key points that will be the subject of debate and could pose a big hurdle in the Senate is the restructuring of the Consumer Financial Protection Bureau (CFPB). Another issue at the forefront is the “Too Big to Fail” provision and how the failure of systemically large financial institutions would be handled going forward.

The bill also would tie all of the financial regulators, regardless of what their funding streams are now, to the appropriations process—with the exception of the Federal Reserve. It repeals the Volcker Rule, the DOL Fiduciary Rule and the Durbin Amendment—a controversial cap on debit card swipe fees for banks. One of the other signature pieces of this legislation is that those institutions with an adequate capital buffer would be exempt from much of the Dodd-Frank regulations and Basel III capital requirements.

In contrast, changes related to commercial real estate lending specifically are fairly minor aspects of the bill. The bill does propose repealing the entire mandate for risk retention rules related to CMBS loans that went into effect at the end of 2016.

“We are still working through and assessing the implications of the many provisions within Financial CHOICE 2.0,” says Chandan. “Over the next couple of weeks, we will have more clarity on what some of these provisions could mean. There is just a lot there.”

Bill faces partisan opposition

The bill did take a small step forward in early May when it passed a vote in the House of Representatives Financial Services Committee. However, it faces tougher opposition with its next stop on the floor of the House and even bigger hurdles in the Senate.

The Trump administration and the Republican majority in Congress are in clear alignment in wanting to repeal significant parts of Dodd-Frank, notes Chandan. The common view—and the driver behind the legislation—is that financial reforms are restricting lending and creating a drag on economic growth. But as a similar move to repeal Obamacare proved—alignment may not be enough to secure the necessary votes to pass key legislation.

The Financial CHOICE Act in its current form doesn’t have “any chance” of getting through the Senate, says Killmer.

“Dodd-Frank is here and it’s going to be here to stay for a while. Repealing and replacing it is just not something that is politically feasible even with the Trump White House in place,” he says. Republicans do not have enough support and votes to repeal and replace Dodd-Frank, and there also are many strong defenders of key provisions within Dodd-Frank, he adds.

Reading the tea leaves

However, the Financial CHOICE Act does provide a preview of what might lie ahead for financial reform in the next 12 to 18 months. That change could come with a new version of the bill that is introduced in the Senate. Even Rep. Hensarling has provided some indication that he would be okay with individual pieces within the Financial CHOICE Act bill being re-examined and reintroduced in the Senate, adds Killmer.

Regulatory change also could materialize in the coming months as the Trump administration has a chance to appoint people to key positions within regulatory and oversight agencies, notes Killmer.

“That’s where most of the change is likely to occur, which is why I don’t think this is an insignificant piece of legislation, because it really does set a backdrop for a lot of future action that could be taken,” Killmer says.