The lodging sector is coming off years of success, in which both occupancy and revenue per available room (RevPAR) have grown across the board. But recent economic trends are beginning to challenge the industry’s ability to maintain previous rates of terrific growth.

Sure, the hotel sector will continue to keep the lights on for all sorts of travelers. It is just that the lights could be a little dimmer, industry researchers are concerned. The lodging occupancy levels reached 65.5 percent in 2015, a 30-year high. That gave the industry a gain of 1.7 percent, but if current trends continue, the percent change in occupancy could slip into negative territory for the first time since the recession, according to research from PwC’s Hospitality Directions US.

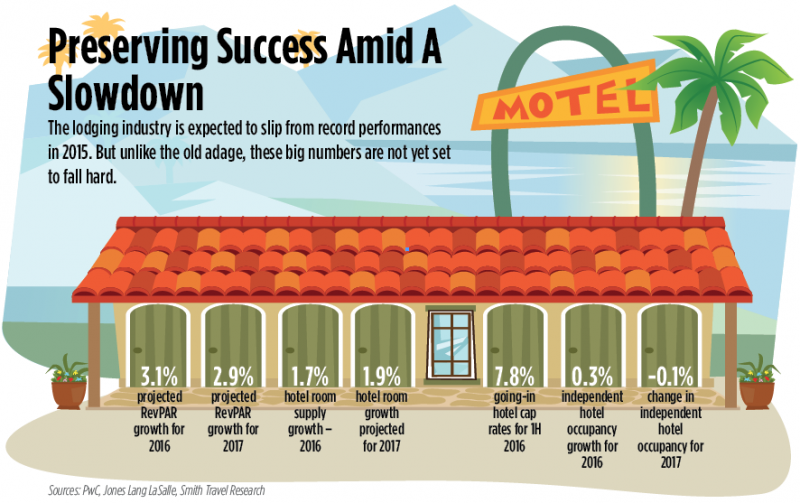

Occupancy levels are not the hotel industry’s only success metric, but even as observers look beyond the surface, they find other reasons for concern. PwC expects that for 2016 the average daily rate growth, which drives RevPAR, will be 3.1 percent, half the level from the previous year. Near-term demand growth is not expected to keep pace with the future supply of hotel rooms, as tepid economic growth and fears of being exposed to areas where the Zika virus has taken hold have curtailed travel.

In the first half of 2016, the hotel industry saw a steady increase in the number of hotel rooms under construction, and it remained consistent with the long-term average of 2.0 percent, which the industry is expected to achieve for 2016, according to the Q2 Lodging Investment Outlook from real estate services firm Jones Lang LaSalle.

That coincided with anomalies that keept growth more muted and less spectacular than it had been prior to 2015, according to Scott Berman, PwC’s principal and U.S. industry leader for hospitality and leisure.

Going independent

The independent sector has been part of the hotel industry’s success, handily achieving the highest levels of positive RevPAR growth, with 4.1 percent in 2016 and 4.3 percent in 2017.

In the lodging sector, the appeal of independent hotels is easy to see. The businesses generally have close community connections; distinct, individualistic atmospheres and they are often named after prominent local heroes. Even large chains have gotten back in touch with their independent streaks.

In 2014 Hilton launched its Curio brand of independent hotels, in which it is essentially bringing successful independent hotels into the Hilton fold. Marriott operates its Autograph collection, dedicated to offering memorable boutique stays to its customers.

“There certainly has been a move toward more independent hotels,” Berman says. “That is being fueled by consumer behavior and consumer sentiment.”

Independent hotels represent half of the available rooms in the U.S. hotel industry now, Berman notes. But their popularity notwithstanding, independent hotels are not immune to downturns. During the recession, the segment lagged the overall lodging industry in levels of occupancy, average daily rates and RevPAR, according to data from Smith Travel Research.

For all of their charm and local ties, independent hotels will still have to grapple with competition from Airbnb, just like the rest of the industry.

Declines in business operations are never pleasant, but at least the occupancy retreat is not expected to be severe, according to PwC. At 2.9 percent, occupancy growth is expected to be at its lowest level since the economic recovery began. But 2016 is still expected to deliver the seventh consecutive year of positive RevPAR growth for the industry, according to PwC.