PricewaterhouseCoopers’ Korpacz Real Estate Investor Survey for the second quarter of 2010 finds that investors are looking for opportunities to buy but are largely frustrated by the lack of quality assets hitting the market.

According to the report, “While a lack of quality offerings is partly to blame for the serene sales activity to date, mixed signals and fluctuating opinions on the near-term performance of the U.S. economy, the banking industry, and the commercial real estate industry are also at fault.”

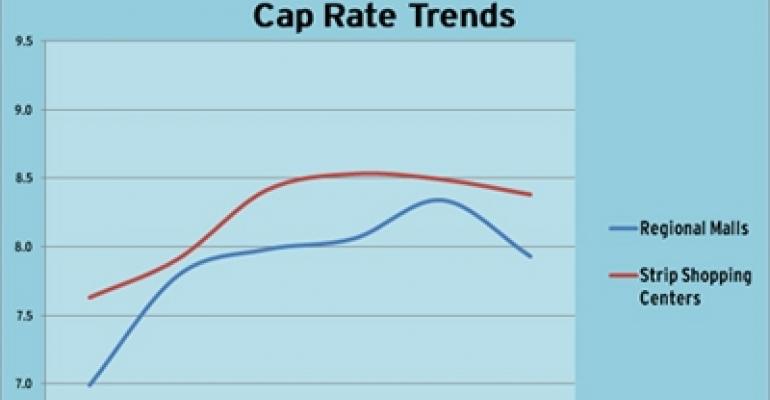

Despite that sentiment, the Korpacz survey—like other recent reports tracking tracking investment sales volumes—showed that cap rates on the deals that are closing are falling sharply. By market, the study found that cap rates across all property types fell in 10 of the 17 survey markets. In addition, cap rates fell on seven of 10 property types.

According to the report, “cap rate compression mostly continues to occur for better-positioned and well located assets that exhibit stable rent rolls and limited near-term leasing risk.” Survey respondents think that trend will continue, with many expecting cap rates to decline or hold steady over the next six months.

The outlook for regional malls is in decent shape. The study points to the fact that retailers have added thousands of jobs in recent months and many tenants are ramping up store expansion plans. With same-store sales posting gains and consumer confidence also rising, the consumer picture does have positive signs even without the economy adding jobs at a robust rate. But the lack of job growth has some wondering whether the rise in retail activity is sustainable. Respondents don’t see a basis for further retail growth without more jobs being created.

In addition, the study notes, “most regional mall assets are still experiencing declines in net operating income and value due to lower rental rates, a greater need for concessions, and growing property expenses.”

Respondents were less sanguine about power centers. According to the report, the sector is “challenged by too much available space, particularly in cities that were hotbeds during the recent residential building boom.” As a result, “[v]acancy and leasing issues remain a concern for existing power center owners, as well as for potential buyers.”

Lastly, in the strip center market the survey found the market is bifurcated. Assets that were on solid footing entering the crisis have held up while weaker centers have deteriorated, leading to a wide gap between the best and worst properties. As a result, investors only want to buy the better assets and are facing stiff competition when deals do become available.

According to the report, “[f]inding unstressed assets for sale, however, remains a challenge as offerings sit well below historical levels. In the first quarter of 2010, strip shopping center offerings totaled $1.9 billion, according to Real Capital Analytics. This total was $6.8 billion during the same time period just two years ago.” Overall, $1.3 billion in strip shopping centers traded hands during the first quarter of 2010—about the same amount as in 2009. That volume is less than one-tenth the volume posted in the first quarter of 2007 when strip shopping center sales totaled $14.9 billion.