Real estate research firm Reis Inc.’s preliminary data for the second quarter of 2010 shows continued deterioration in fundamentals at neighborhood and community centers and regional malls.

Vacancies at both property types rose and continue to set new records each quarter. For shopping centers, vacancies are at their highest point since 1991 and for regional malls vacancies are at their highest point since Reis began tracking the figure at the end of 1999.

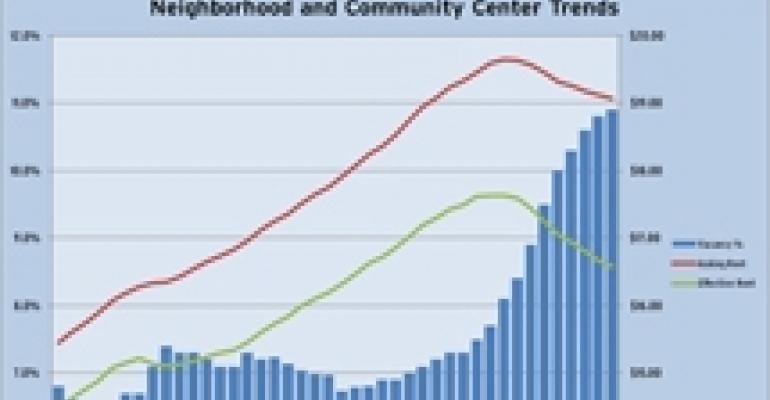

At neighborhood and community centers, the vacancy rate rose to 10.9 percent in the second quarter of 2010. The last time the vacancy rate reached 11 percent was in 1991. Asking and effective rents continued to decline, falling by 0.3 percent and 0.5 percent respectively. For regional malls, the vacancy rose to 9.0 percent. Asking rents fell by 0.2 percent—the seventh straight quarter of rent declines.

According to the report, “The continuing plight of retail properties across the nation reflects the tepid, uneven pace of economic stabilization and recovery.”

Overall, the market gave up 1.85 million square feet of occupied space. But development has declined as well, bringing less than 400,000 square feet of strip mall space online, the lowest quarterly level of new completions on record since Reis began publishing quarterly data in 1999. “Negative net absorption once again outstripped the amount of newly completed space (a pattern that has been operative since late 2009) indicating that existing buildings continued to bleed and give up occupied stock, even as newly completed buildings contributed some positive amount to occupied space (unless they came online 100 percent vacant, a common occurrence over the last three or so quarters),” according to the report.

Reis did note, however, that eleven out of 80 markets posted slight increases in effective rents, “indicating that some markets may be close to or have hit bottom when it comes to rent drops and the need to offer concession packages.” Overall, the vacancy rate for neighborhood and community centers increased in 41 of the primary 80 metropolitan areas and effective rents fell in 67 out of 80 markets. This implies that, “although some markets may show signs of stabilization, most retail landlords are still under tremendous pressure.”

The research firm maintains a bleak outlook on the sector overall.

According to the report, “[W]e are experiencing record magnitudes of deterioration, but it tracks expectations. We expected labor markets to recover in fits and starts; June’s headline figure for job losses highlights the difficulty of assuming a linear trend in job growth once we see any sign of economic stabilization. Fifteen out of the 21 months following the official end to the last recession in late 2001 were marked by job losses—not job gains. We expect continuing volatility in financial markets, retail spending and consumer confidence over the next 12-18 months, and this will weigh down recovery for retail properties until late 2012.”