(Bloomberg)—U.S. shoppers may be ordering more clothing than socks and underwear on Amazon after all.

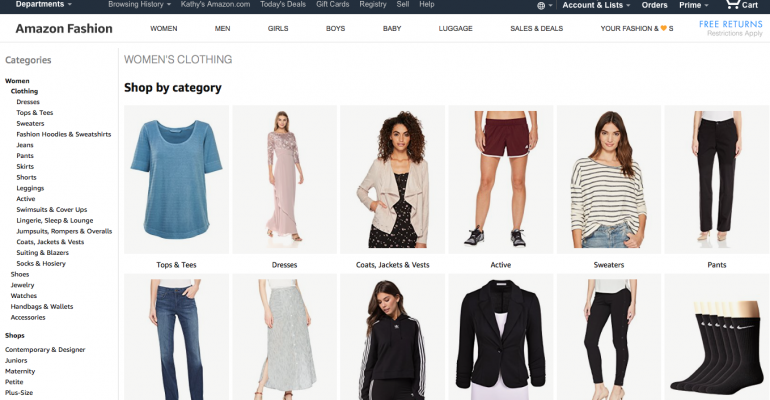

Amazon.com Inc. is spiriting away share of apparel sales from Target Corp., Macy’s Inc. and J.C. Penney Co., according to a report Thursday by Coresight Research. Amazon Fashion is tied with Target as the second-most-shopped apparel retailer in the U.S., behind Walmart Inc., as measured by number of shoppers, the survey found. More than 20 percent of respondents said they have switched more of their apparel spending to Amazon and away from Macy’s and J.C. Penney.

Amazon’s fashion business is underpinned by those who are already members of the site, according to the study. While 46 percent of all apparel shoppers surveyed said they had bought clothes or shoes on Amazon in the past year, almost two-thirds of Prime members had done so, the research firm found.

“Further growth in Prime membership will, in the near term at least, be the foundation on which Amazon will build greater share in the apparel category,” Deborah Weinswig, managing director of Coresight Research, said in the report.

The findings come as traditional retailers struggle to boost their sales, especially in apparel, which has seen outlays shrink. Americans spend just 3.1 percent of their household budgets on clothing, according to government data, shifting dollars to travel, technology and experiences.

Online upstarts and low-cost fast-fashion chains have drawn trend-conscious consumers in search of value away from department stores and full-price retailers. Amazon has cultivated a low-price image among shoppers, with 48 percent of respondents expecting to pay less than they would at another company, Coresight said.

Retailers have been hurt by depressed prices, though a 1.7 percent gain in January offered some solace, according to the latest government inflation report.

Private Label

Amazon, based in Seattle, is working to increase its share of apparel sales, rolling out private-label brands to fill in gaps in its lineup. The company is said to be tapping some of the biggest athletic-apparel suppliers for its proprietary sportswear brand, people familiar with the situation said in October. One in nine shoppers have already bought Amazon’s private-label clothes or shoes, according to Coresight Research. Nike, Under Armour and Hanes were the outside brands respondents shopped for most.

While Amazon has been heralded as the harbinger of death for many American retailers, Weinswig acknowledged that “no research firm truly knows” how much clothing and footwear Amazon sells. The company doesn’t disclose that data.

To contact the reporter on this story: Lindsey Rupp in New York at [email protected] To contact the editors responsible for this story: Nick Turner at [email protected] Lisa Wolfson, Jonathan Roeder

COPYRIGHT

© 2018 Bloomberg L.P