It is no secret that brick-and-mortar retailers are facing unprecedented headwinds. The headlines are filled every day with the latest updates on faltering sales and diminished fortunes. In this tumultuous environment, the real estate these ubiquitous retailers occupy may be a critical resource in fending off the competitive onslaught.

The c-suites of many retailers are populated by executives who rose through the operational ranks. They have a keen understanding of consumer behavior and extensive expertise in what it takes to attract shoppers to their stores. To them, real estate is where their brands sell sweaters, cheeseburgers or grocery items. In this respect, real estate has traditionally been viewed as an operating asset that needs to be in the right location and projects the appropriate brand image to potential consumers.

Given the increasingly competitive retail environment, retail c-suite executives would be well-served to shift their thinking and begin viewing real estate as a financial asset rather than just an operating location. Whether the retailer owns or leases their real estate, there are financial strategies related to those locations that could help them weather the current storm.

Retailers that own much of their real estate have far more financial options. The starting point toward identifying the most appealing path is to conduct a thorough assessment of what the owned portfolio is worth. That figure typically centers on the value of the locations as ongoing operations. But with commercial real estate values now at all-time highs, the valuation analysis must be broadened to include other potential uses.

Some of the key questions to consider include: What might a department store box be worth if it were sold to a mall owner that wants to turn it into a modern movie theater complex surrounded by exciting restaurant venues? What might the stand-alone, big-box store location be worth if it were sold to a developer and transformed into an apartment complex? Does a retailer need all the owned square footage or could it reduce its current footprint and sell or lease the excess real estate area?

Although retail real estate values have fallen recently, they are still near all-time high levels.

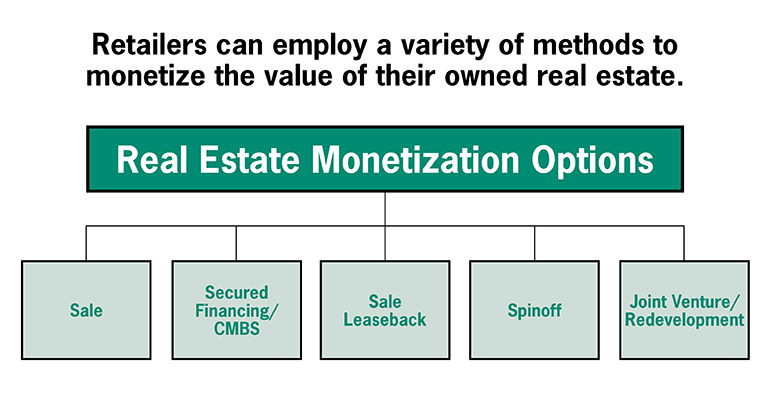

Monetization strategies ranging from sales and sale/leasebacks to mortgage financings and the formation of development joint ventures are all paths to extracting value from retailer-owned real estate. For each option, retailers must consider the effect on operations, taxes and brand presence. Yet, with some public retailers trading at valuations that are demonstrably less than the value of just the owned real estate (i.e., shareholders are getting the retailer for free), these pros and cons must be rigorously evaluated.

Retailers that lease their stores have options, too. In those cases, the evaluation typically centers on which stores to keep open and which ones to close. While the recent profitability and cash flow of a particular store are key criteria, the operating path that store is about to take is just as important. Who owns the mall/shopping center and what capacity do they have to fund improvements? What is the outlook for the anchor stores? Is the property at risk of being foreclosed by a lender? What alternative space is available in that center or others nearby? How are nearby retailers faring? What is the quality of retailers moving out versus those moving in?

The boards of publicly-traded retailers have a responsibility to push management teams to evaluate real estate from a financial standpoint, not just from an operational point of view.

Articulating a credible real estate strategy will allow management teams to control the message with shareholders. Companies that don’t take these important steps should not be surprised when an activist investor shows up. Being unprepared opens the door for a vocal shareholder to take over the message, possibly creating an unwelcome influence on the fate of the company.

Jim Sullivan serves as president of advisory & consulting for real estate research firm Green Street Advisors.