For those skeptics who were convinced that green building was a mere passing fad, a new survey by National Real Estate Investor and its sister publications may prove otherwise. The survey reveals that not only is green building gaining momentum as a commercial real estate strategy, but it is also vying for status as the new industry standard.

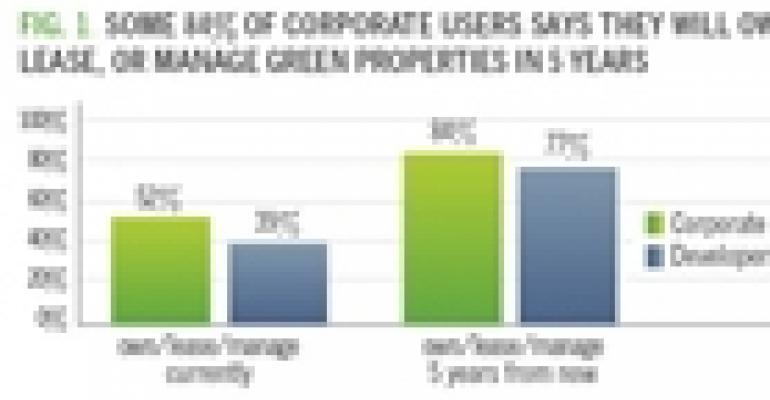

In fact the exclusive survey, which drew responses from 218 corporate users and 166 developers of commercial real estate, reveals that 52% of corporate respondents and 39% of developer respondents currently own, manage or lease at least some “green” properties.

Even more compelling is the fact that the focus on sustainable real estate is clearly on the rise with 84% of corporate users and 77% of developers expecting to own, manage or lease at least some green properties five years from now [Fig. 1].

“I think there is a tremendous amount of momentum for sustainable development,” says Tom Bisacquino, president of the National Association of Industrial and Office Properties (NAIOP). “The cost of energy is growing exponentially, and many feel that energy costs will continue to rise. So the business case for developing green is getting stronger and stronger.”

Generally, the “green” label in commercial real estate applies loosely to a growing list of sustainable building practices, ranging from energy-efficient lighting and air purification systems to recycled carpet. Specifically, green buildings are being measured by emerging industry standards such as Energy Star and the U.S. Green Building Council’s Leadership in Energy and Environmental Design (LEED) rating system.

Energy Star is a joint program of the U.S. Environmental Protection Agency and the U.S. Department of Energy that focuses on energy efficient products and practices. Buildings that earn the Energy Star designation use about 35% less energy than average buildings. More than 3,200 buildings totaling nearly 575 million sq. ft. carry the Energy Star seal of approval.

In contrast, the LEED program promotes a whole-building approach to sustainability by recognizing performance in five key areas that include human and environmental health, sustainable site development, water savings, energy efficiency, materials selection and indoor environmental quality.

Survey results support the premise that corporations and developers are embracing green building practices. Respondents expect that green building ownership and management will increase dramatically in just a few short years.

Corporate users anticipate that the amount of green facilities they own or lease will more than double from 9% to 21% in the next five years. Developers also expect the volume of green properties in their portfolios to take a similar jump from 9% to 20% by 2012 [Fig. 2].

“I think that 21% is pretty conservative,” says Randy Knox, Adobe’s senior director of global facilities services at Adobe Systems Inc. in San Jose, Calif. “I think green building is really starting to snowball.” Adobe is the only company in the world to occupy three platinum-level LEED buildings, totaling 960,000 sq. ft., the highest rating offered by LEED.

The software giant plans to roll out more green design elements and pursue LEED certification for commercial interiors within its 2.7 million sq. ft. portfolio of leased space. “We do a lot of development work around the world, and we are looking at taking this certification process global,” Knox says.

A snapshot of respondents shows that nearly half of corporate users (48%) own or lease more than 150,000 sq. ft. of space, while 47% of developers own or manage more than 150,000 sq. ft. of space.

Respondents are most likely to be involved in office and retail. Among developers, 55% own or manage retail, followed by office (48%) and mixed-use and hospitality (35% each). On the corporate side, 51% of respondents own or lease office space, followed by industrial (42%) and retail (25%) [Fig. 3].

Green gains momentum

One key indicator about the speed with which green building is taking hold can be found in attitudes toward the site selection process. About half of respondents — 46% of corporate users and 51% of developers — consider green design either important or extremely important.

Only 17% of corporate users say green design is not at all important in the site selection process, while just 10% of developers say it is not at all important to their company for current or future development [Fig. 4].

Corporations ranging from Bank of America to Best Buy are incorporating green building as part of their real estate strategies, and developers are clearly responding to the rising demand for these facilities. “Tenants understand that energy savings go straight to their bottom line, and they also are concerned about the environment they are creating for their employees,” says Jerry Lea, a senior vice president at Houston-based developer Hines, an Energy Star partner since 1999.

About 18 months ago, Hines adopted a strategy to LEED-certify all new office projects in which it has an ownership stake. Currently, the developer has more than 50 buildings that are either LEED-certified, pre-certified or registered for certification.

In September 2006, Hines launched a joint venture with CalPERS to create a Green Development Fund with more than $120 million in equity that focuses solely on developing LEED-

certified office buildings. “The competitive nature of the business is such that developers will continue to ratchet up and green building will become more prevalent,” Lea says.

Hines is not alone. Major commercial real estate developers across the country have implemented similar strategies. “We want to do sustainable development for 100% of the work that we do,” says Dan Young Dixon, director of national design for Opus Architects and Engineers, a division of Minnetonka, Minn.-based Opus Corp.

For example, Opus recently completed an 820,000 sq. ft. office complex for Medtronic Inc. in Mounds View, Minn., that incorporates highly energy efficient mechanical systems, water efficient landscaping techniques and low-emitting construction materials.

“What our company is staging for over the next five to 10 years is that sustainable design will just become a best practice,” says Dixon. Opus has more than 12 million sq. ft. of sustainable buildings complete or under development, including more than a dozen LEED-certified or registered facilities.

Corporations embrace value

The desire to cut energy costs is the main force pushing green building into the mainstream. Four in five respondents indicate energy efficiency is important to their company when selecting, acquiring or developing a green building.

When asked what are the most important factors when choosing green buildings to buy or lease, corporate users most frequently cite energy efficiency (81%) followed by water savings (53%) and indoor environmental quality (50%) [Fig. 5].

Other issues that register high among corporate users when selecting space to buy or lease include selection of green building materials (38%) and sustainable site development (34%).

Energy efficiency likely generates the most attention because it also produces the biggest payback on green design. Adobe is a case in point. The firm spent $1.4 million over the past five years to retrofit all three of the office buildings at its corporate headquarters in San Jose. That investment is paying off big on Adobe’s bottom line with roughly $1.2 million in energy savings each year.

Corporate users believe the most significant benefits of green building design are lower energy costs (78%) and that it has a low impact on the environment (75%) [Fig. 6].

Most developers also believe lower operating costs are the greatest benefit of green building design (79%), while being environmentally friendly also rated high at 74%. The ability to differentiate in marketing followed at 46% [Fig. 7].

Green building elements added about 2% to the overall building cost of the $500 million Hearst Tower in New York. The 46-story office tower opened in October 2006 and is home to about 2,000 employees.

“In the scheme of things, it was more expensive,” says Brian Schwagerl, vice president of real estate and facilities planning at Hearst Corp. “But why would we want to build anything less than what was going to make it a better building? I didn’t buy lesser-quality flat screen TVs, so why would I buy a lesser-quality air handling system?”

Indeed, most corporate users say they would be willing to pay more for LEED-certified buildings, with more than one-third (39%) willing to pay 1% to 2% more; 27% would pay 3% to 4% more; and 23% would pay 5% to 9% more. Another 8% say they would even be willing to pay 10% or higher [Fig. 8].

Developers question ROI

The most heated debate in the commercial real estate industry surrounding green building is whether the added upfront cost will translate to higher building values and higher rents. Although some industry estimates indicate that green building typically adds about 1% to 2% to the overall project cost, one in four developers — both those who owned or managed green properties and those who had none — indicated that building green adds 10% or more to construction costs [Fig. 9].

The added expense of building green is typically recouped through operational savings in the first three years of operation, according to the U.S. Green Building Council. However, since most landlords pass those energy costs — and savings — through to their tenants, the main focus for developers is on how green building can directly impact the bottom line through higher sale prices and rents.

Developers were split on whether they would charge the same or higher rents for green buildings, with 42% reporting that they would charge the same rents for green and non-green buildings, while 40% say they would charge higher rents for green buildings. Among those that would charge higher rents if they were able, 15% say they would charge between 3% and 4% additional [Fig. 10].

The U.S. Green Building Council contends that green buildings have higher lease rates and occupants are healthier and more productive. “The average return on investment in a green building is 20% — and that’s a number that’s relevant to any building owner,” says Rick Fedrizzi, president, CEO and founding chair of the council. NAIOP’s Bisacquino agrees that green buildings will have a direct correlation on building values and rents in the near future. “I personally feel that within the next three to five years, the definition of Class-A office space will be green,” Bisacquino says. “If a building is not green, it won’t be classified as Class-A.”

Green lending programs

Most developers and corporate users are not taking advantage of insurance or lending programs that offer favorable rates for green buildings. Only 20% of corporate users and 18% of developers say they found favorable financing terms for green developments.

Likewise, 24% of corporate users and 18% of developers have found favorable insurance terms for green developments. However, such programs could become more prevalent in the future, producing added savings for developers and corporations [Fig. 11].

“Developers are looking at green buildings as the new standard,” says Jamie Woodwell, senior director of commercial and multifamily research at the Mortgage Bankers Association. Lenders recognize that market shift and are searching for ways to participate in that green building trend.

Lenders have been active in financing environmentally friendly projects for years, and now a growing number of lenders are promoting green lending with specific programs that target Energy Star or LEED-certified buildings, Woodwell adds.

Bank of America Corp., for example, announced a 10-year, $20 billion initiative last March to support the growth of environmentally sustainable business activity through lending, investing, philanthropy and the creation of new products and services.

In accordance with that, Bank of America plans to create customized solutions for its commercial real estate lending clients who are developing environmentally sustainable designs.

Smaller lenders also are getting in the game. United Community Bank in Savannah, Ga. announced this past summer that it would offer property owners, builders and general contractors a reduction of 25 basis points in construction financing for any commercial or residential project that achieves LEED or EarthCraft certification from the Southface Energy Institute in Atlanta.

“We are trying to do our part to support green building, and it may make builders more conscious of sustainable building,” says Deepika Paul, a senior vice president at United Community Bank. The bank now has three green loans that it is underwriting. Only those loans that the bank holds in its own portfolio are eligible for the discount.

The insurance industry also is taking notice of the benefits of green building. Some insurance providers are beginning to recognize that green buildings should be rated more favorably due to their high-performance design that often involves state-of-the-art specifications for mechanical systems, as well as more rigorous inspections to guarantee LEED or Energy Star ratings.

Fireman’s Fund Insurance Co. based in Novato, Calif. was the first U.S. insurance company to offer special coverage for green designated commercial properties. Fireman’s Fund green coverage offers reductions up to 5% of the total premium on green buildings.

LEED sets the bar

One of the biggest advances in sustainable development has been the movement toward a universal standard that quantifies green building with the LEED rating system. More than one-third of respondents, including 41% of developers and 37% of corporate users, have heard of the LEED program.

Every business day $100 million worth of construction registers with LEED, and an estimated 10% of the construction market is currently following green building practices, according to the U.S. Green Building Council.

LEED projects are found in every state and in 26 countries with roughly 1,059 certified projects and 7,843 registered or pending projects worldwide. Although the 4 billion sq. ft. of LEED projects represent a small fraction of the overall commercial real estate universe, the volume of LEED-designated buildings is clearly on the rise.

However, it appears there is still a bit of gray area when it comes to understanding LEED and the definition of green buildings. Of the green buildings in their portfolio, more than half of respondents — 63% of corporate users and 55% of developers — were unsure or did not know their specific designation.

The Hearst Tower was the first occupied building in New York to obtain a gold-level LEED certification. “A lot of times I think the discussion on sustainability gets lost in the language,” says Schwagerl of Hearst Corp. LEED basically provides a blueprint for creating a sustainable building. The guidelines make it easy for a layperson to understand the various elements of green building, and provide a good way for the whole building team to stay on track — understanding and achieving the same goals, he adds.

Four in five corporate respondents (80%) who are familiar with LEED consider it an effective standard for energy savings, while 74% believe it is an effective standard for environmentally friendly building. Among developers, 56% believe LEED is an effective standard for energy savings, and 62% say it is an effective tool for environmentally friendly building.

Forest City Enterprises based in Cleveland has obtained LEED designations on several major projects, including a silver rating for its Northfield Stapleton retail development in Denver. “LEED has served as a catalyst for the green discussion, but what is permeating the industry is a focus on best practices,” says Jon Ratner, director of sustainability initiatives for the developer.

Not only did Forest City work to ensure that the exterior core and shell aspects of the 1.2 million sq. ft. project followed LEED guidelines, but also worked to educate and influence its 50 tenants to implement green building practices within their own leased spaces.

“We are committed to building green,” Ratner notes, “but we recognize that this is a journey that we are on in terms of the constant exploration of new techniques, new technology and new approaches to sustainable development.”Are incentives falling flat?

Federal, state and local governments have been working to encourage sustainable development with programs ranging from tax rebates and grants to preferential zoning and fast-track development schedules.

A variety of legislation, resolutions, ordinances, policies, and incentives to encourage LEED initiatives can be found in cities, counties, towns, states, schools, and federal agencies across the United States and Canada.

The majority of corporate and developer respondents — 74% and 71% respectively — have noticed an increase in green building initiatives from local, state and federal government. Yet nearly three-fourths of respondents — 77% of corporate users and 72% of developers — have not taken advantage of government incentives for green building developments.

One reason the use of incentives is not higher is that government programs vary widely across the country depending on the city, county and state in terms of the type of programs offered, how they operate, and how effective they are at encouraging green building.

Among respondents who have taken advantage of incentives, the most commonly used are tax breaks, fee waivers and a “fast-track” permitting process. Among corporate users, 14% have used tax breaks while 7% have used fee waivers and 6% have taken advantage of fast-track permitting. Some 15% of developers say they have used tax breaks, followed by fast-track permitting (5%) and fee waivers (4%) [Fig. 12].

Hearst received a $250,000 grant from the New York State Energy Research Development Agency, which it used to hire green consultants and get its project on track during the early planning stages. “I believe these grants make a difference, and I think it’s important to have government as a partner in your project going forward,” says Schwagerl.

Although government incentives do not appear to play a major role in respondents’ decisions to develop green properties, 47% of corporate users and 46% of developers indicate that government incentives somewhat impact decisions.

About one-third of respondents say that incentives play no role in the decision-making process. Yet 75% of corporate users and 80% of developers also say they would like local governments to develop tax incentives for green building owners.

The new green standard

Green building practices are clearly becoming entrenched in the commercial real estate universe. In fact, nearly half of respondents — 51% of developers and 47% of corporate users — believe that green building is not only a long-term phenomenon, but also that green building requirements will become part of future building codes.

Those requirements are already surfacing in mandates for public facilities. President Bush issued an executive order in January 2007 stating that new construction and renovations of government buildings should comply with federal sustainable design principles.

As a result, the General Services Administration issued its own directive requiring that all of its new buildings be constructed to meet a minimum of silver-level LEED certification.

The main reason that green building may be increasingly viewed as a requirement rather than an elective circles back to the focus on reducing energy consumption and energy costs.

More than one-third of respondents — 41% of corporate users and 33% of developers — say the future of green building is pegged to energy prices. In addition, 50% of government respondents say that elected officials and energy prices are the primary drivers of green building [Fig. 13].

“There’s a dialogue about energy going on across the nation, and I think over the next few years our decision makers are going to wake up to the basic facts,” says Austin Mayor Will Wynn, who also serves as chairman of the Energy Committee for the U.S. Conference of Mayors.

In the future, cities and states will face economic and environmental challenges related to energy consumption. Buildings account for 38% of U.S. carbon dioxide emissions, 71% of electricity use and 40% of total energy use, reports the U.S. Department of Energy.

“You’re going to start to see more and more recognition that the cleanest, cheapest megawatt you’ll ever have is the one you don’t have to produce in the first place,” Wynn says.

For example, the U.S. Green Building Council is partnering with the American Society of Heating, Refrigerating and Air-Conditioning Engineers and the Illuminating Engineering Society of North America to develop a new minimum standard for green building.The goal of Standard 189 is to further drive green building into mainstream practices, says Fedrizzi. It will address key areas of performance including energy efficiency, greenhouse gas emissions, sustainable site selection, water usage, materials and resources, and indoor environmental quality.

When completed sometime in 2008, Standard 189 will be an American National Standards Institute (ANSI) accredited standard that can be incorporated into the building code. Although industry associations such as NAIOP do not support government mandates for green building, the organization does favor incentives.

“Clearly, we think the commercial real estate market will be ahead of what building codes require simply because clients will demand it,” says Bisacquino. “The tenant’s demand for green is growing. The question is whether there is a willingness there to pay for it.”