Commercial development is a unique industry. Different from residential professionals, commercial real estate professionals deal with larger projects, higher risk and more complex technical disciplines. At the same time however, the business is just as personal. That’s why those who develop careers in commercial development typically have great people skills and are business savvy by nature. So it seems a little contradictory to say that commercial development partnerships are destined to fail—but that’s what I’m saying.

And I’m not the first to say it. In an article titled The Nuts and Bolts of Real Estate Joint Venture Partnerships, Jonathan Farrell writes, “While it may seem counterintuitive, all parties [in a partnership] should start by looking at their exit strategy.” Would you enter into a marriage while simultaneously planning your divorce strategy? I didn’t think so.

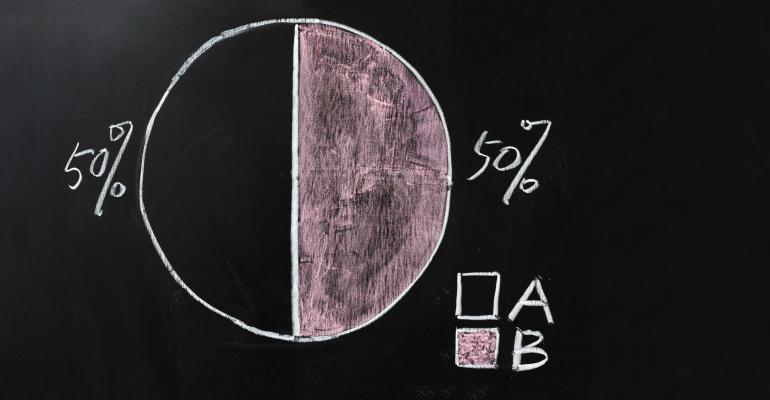

It is important to note that when I reference partnership, I’m defining the term as general 50/50 partners. Financial partners—those who infuse capital and seek return, but are not invested in how you get that return—are a necessity in commercial real estate development. But unlike a limited financial partnership, a general partnership is difficult to maintain. In fact, according to Forbes, “Partnership is far more difficult to maintain than marriage. Whereas 50 percent of marriages end in divorce, the number is closer to 80 percent for business partnerships.” As a married man—and someone who has been involved in multiple partnership models—I know this firsthand. Below I oultine why commercial development partnerships are destined to fail:

Synergy is a dangerous word. Oftentimes partnerships develop under the assumption that by working together individuals can achieve what neither can do independently. And, in theory, this makes sense—one partner can focus on acquisitions, while the other handles finances, for instance. Unfortunately, this synergy-based approach is not sustainable in the commercial development world. People are people, and we are all constantly evolving. There’s a good chance that neither you, nor your partner, will handle one deal in the exact same way you handle the next. We learn, we grow and we adapt to new roles—deal after deal, year after year. Robert Shemin, bestselling author of Successful Real Estate Investing, makes this point: “It should never be a 50-50 partnership; someone has to be in control and make decisions, and that person should be you. Make sure you work with silent partners who do not interfere [with day-to-day decision making]. About 70 percent of real estate partnerships fail because two equal partners cannot agree on anything.”

Commercial development is volatile. In an industry that inherently involves big risk, you have to expect the occasional loss. And, once again, people are people. There’s no telling how principles and standards might change in the face of adversity. Take the case of Stan Kroenke and Michael Staenberg, for example,—long-time partners turned legal combatants. For two decades, Kroenke and Staenberg were partners in building one of the country’s biggest developers of shopping centers. They became two of the richest men in Missouri. But after a sudden string of events, Kroenke sued his longtime colleague, seeking $20.2 million he said Staenberg reneged on paying him as part of the unwinding of their complex web of real estate holdings, and fighting to block repayment of a $1.2 million loan Staenberg had made to their company. That was three years ago. Then, in November of 2015, the dispute spilled over into the St. Louis Rams owner’s potential plans for a Maryland Heights retail development. Staenberg accused Kroenke of going behind his back to acquire land in Maryland Heights. This legal feud is a prime example of what could—and likely will—go wrong when big money and bigger risk is involved. When each partner has different expectations and a different idea of what is fair, the road to recovery is a long one.

Two is not better than one. Having multiple “faces” of a company can be dangerous for several reasons. Commercial development is built on trusted relationships and a trust in the potential of a mutually beneficial outcome. This faith is built on consistent messaging and confidence in one person; it cannot be replicated with a second company figurehead. Consistent, trustworthy messaging is not only essential to relationship-building, but also to building a solid public reputation. If media were to catch wind of a statement your partner made and you don’t agree with it, your brand’s credibility is on the line. I know firsthand that it’s tough to operate a business while constantly worrying about what someone else is saying and doing. When more than one person is in charge of a brand—each making their own decisions and stating their own opinions—the results can be disastrous, especially in commercial real estate development.

Final Thoughts

Having been involved in commercial real estate development for more than two decades, I’ve experimented with several different business models and partnership structures. The takeaway I want to share with you? Don’t waste your time on experimentation; general partnerships in this industry do not work.

As CEO of Missouri Land Company (www.molandcompany.com), Matt Burgess has been developing commercial and residential real estate for more than two decades. He has experience in site development, land acquisition, land planning, construction, rental properties and general contracting. He can be reach at (573) 701-0972.