With property sales at a minimum and accurate capitalization rates difficult to ascertain, investors are increasingly looking at replacement cost as a method of establishing pricing parameters. The comparison of sales price to estimated replacement cost is a common component of property analysis.

A sales price below replacement cost is generally considered one potential indicator of attractive pricing for the buyer, but given the current market conditions nearly every property is expected to trade at some discount to replacement cost.

We believe that a consistent approach to estimating replacement cost is a necessary starting point in order to evaluate the discount a given price represents. In addition, an examination of the relationship between current rents and replacement rents (the rent necessary to justify new construction) is a helpful tool to estimate the potential for future rent growth.

A basic principle of real estate economics holds that new development occurs only when rents justify the costs of development, including a reasonable return to compensate for development risks.

This pressure to develop occurs at the point in the market cycle when demand exceeds existing supply such that market rents rise above replacement rents.

Development then occurs until the excess demand is satisfied. Typically, the addition of new space to the market overshoots demand, causing vacancy to increase and putting downward pressure on rents. Market rents fall back below replacement rents, removing the incentive for additional new construction until demand again outpaces supply.

Calculating replacement cost

The practice of preparing a reliable cost estimate for new development is complex, requiring both an array of data and an understanding of the technical aspects of construction. This type of detailed analysis is typically not realistic in the context of making an investment decision for an existing asset, however.

Instead, replacement cost numbers are typically generated based on rough estimates of costs per square foot suggested by local brokers or contractors, often with minimal regard to the specifics of building types, construction methods, or locations. The challenge of estimating land prices, particularly in the current market, adds to the complexity of the task.

In order to provide a more consistent approach, we suggest requesting two or more estimates from reputable developers and/or consultants familiar with the market and product type.

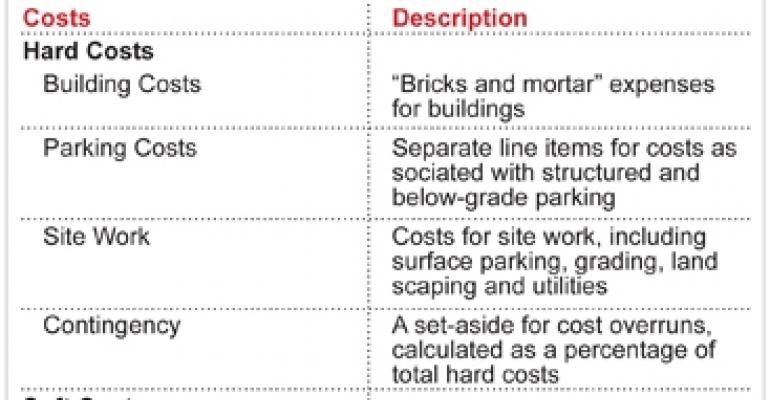

In developing these estimates, it is important to provide a definition of what costs should be included, so that apples-to-apples comparisons are possible. We divide the various components of replacement costs into the general categories summarized in Figure 1.

FIGURE 1: APPLES-TO-APPLES COMPARISONS REQUIRE DEFINING THE COMPONENTS OF REPLACEMENT COST

Once a reasonable conclusion of replacement cost is determined, additional adjustments are necessary to assess the impact of depreciation on an older asset relative to new construction. The impact of depreciation may be estimated based upon a comparison of the premium for rents in new buildings versus older buildings in the local market, adjusting for differences such as amenities and location

Calculating replacement rents

Market rent levels encourage or discourage new development based on the relationship between those rents and development costs. Once a reasonable estimate of replacement costs is defined, then we can also determine the rent necessary to justify that new development.

Replacement rent is a function of replacement cost, the required return on costs (or risk premium), and an adjustment to acknowledge some level of expected vacancy and expenses. A simplified example of the calculation is shown in Figure 2. For illustration purposes, we assume an absolute net lease so that no adjustment is necessary for expenses.

FIGURE 2: REPLACEMENT RENTS REFLECT COSTS, RISKS AND VACANCY ASSUMPTIONS

Based on these assumptions, a developer seeking a 10% return on cost and an expected stabilized vacancy rate of 5% would need to be comfortable with the ability to achieve average rents of $31.58 per sq. ft. in a stabilized building in order to proceed with a project with an estimated total cost of $300 per sq. ft.

This calculation then allows for a comparison between replacement rents and current market rents. Given the steep decline in rents over the past two years, market rents are generally well below replacement rents.

We can then use the difference between current market rents and current replacement rents as one tool in estimating future rent increases. Even assuming a traditional 3% increase in construction costs over time, market rents will have to increase at a faster pace at some point to return to parity with replacement costs.

We believe that a scenario that includes a return to replacement rents may be an appropriate consideration in investment analyses, likely calling for a more substantial spike in rents at some point in the future when demand again outpaces existing supply.

This approach would be most appropriate for the strongest markets and submarkets where there are reasonable expectations for increasing demand, especially when combined with a relatively high level of supply constraints.

Of course, the timing and size of that rent spike will vary by market and submarket, and must be estimated based on a thorough analysis of local supply and demand characteristics.

David Lynn is managing director and head of U.S. research and investment strategy with ING Clarion based in New York.