The key to understanding mobile home park investing is to look at the raw power of affordable housing and how it relates to today’s consumer. The household income for 20% of all Americans is under $20,000. That’s 60 million people.

Based on the government’s suggested ratio of housing costs to total income — about 33% — these families can afford around $500 per month. But the average apartment rent in 2010 was over $1,000 per month. So where can you live for $500 per month? There are only two options: low-rent apartments and mobile home parks.

So who wants to live in a mobile home? Just about everyone, as it turns out. Low-rent apartments have many characteristics that tenants find appalling, including high crime, constant noise on all sides and above and below, no outside play space, inability to have a pet, and no sense of community.

Mobile homes, however, offer the chance to have privacy, a small yard, a pet, and a neighborhood feel much like a subdivision. A mobile home in a mobile home park is infinitely more desirable than its multifamily alternative. Perhaps that’s why 8% of all Americans already live in a mobile home.

Least expensive form of detached housing

So how did mobile homes get so cheap? In the 1970s, the Department of Housing and Urban Development began to regulate the mobile home manufacturing industry and allowed many construction methods to reduce the cost of the product.

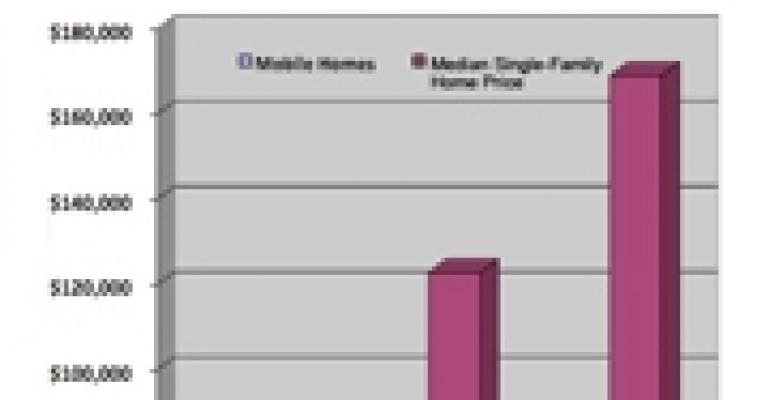

Still, the disparity between mobile home and traditional stick-built housing has a lot to do with the soaring value of stick-built, single-family homes. As you can see in the following chart, while mobile home prices rose over time, the prices of stick-built homes skyrocketed.

As a result, a new mobile home costs less than one-third of its stick-built relative, or about $30 per sq. ft. Billionaire investor Warren Buffett — who is known for his attraction to value and low costs — is the largest owner of mobile home manufacturing and financing in the United States. But that’s only half the story.

There is an extremely large and fluid secondary market for mobile homes, a market where homes often sell for as low as $1,000. Private owners as well as mobile home park owners and lenders make these homes available through repossessions.

Consumers can access these homes through traditional newspaper classifieds, signs on mobile home park frontage, and word of mouth. When you factor in this secondary market, the price drops to as low as $1 per sq. ft. Mobile homes are, without question, the least expensive form of detached housing.

Understanding mobile home parks

The other part of the equation in this affordable housing model is the mobile home park. Mobile home park rents remain extremely affordable, with the average rent in the U.S. around $200 to $300 per month. With a new home, the sum of mortgage and lot rent is around $700 to $1,000 per month. However, with used homes, this sum can be as low as $300 to $500 per month. Affordable lot rents are as important a part of the model as home prices.

Owners of mobile home parks make good money at rents this low. The average expense ratio for mobile home parks is 30% to 40% of the gross revenue. On top of that, mobile home park owners are essentially renting land, so that they do not have to save for expensive capital improvements.

Mobile home parks sell for capitalization rates of 7% to 10%. As a result, the average park owner has no pressure to dramatically increase rents. And when rents are raised, it is in affordable increments of $10 to $20 per month.

One of the bedrocks of the mobile home park as an investment vehicle is the inability for most customers to ever leave. At a cost of around $4,000 to move a mobile home from point A to point B, few tenants can afford to move out even if they are unhappy with the product or the price. This locked-in tenant base is what enables park owners to enjoy phenomenally stable revenue figures, even in major recessions.

What can make this business model go bad?

Most people would agree that no customer, when offered a stick-built home or a mobile home, would opt for the mobile home. Mobile homes are desirable when compared to apartments, but not when compared to brick homes in a subdivision. However, many investors sometimes forget this precept with terrible consequences.

In some parts of America, lot rents have been raised to levels in excess of $500 per month, so that the sum of lot rent and mortgage can be well over $1,000 per month. In this cost range, mobile home owners have many other housing options that are more attractive, such as stick-built homes and luxury condominiums. As a result, they walk off and abandon their new mobile home. Their departure destroys the consistent revenue model of the park, and may even jeopardize its ability to hold firm on its rent level.

Continuing to provide affordable housing should be the primary aim of mobile home park owners in order to avoid crossing into the danger zone of having to compete with more attractive housing stock.

Conclusion

The mobile home park is an excellent investment tool when geared toward providing affordable housing. It delivers the lowest cost form of detached housing in the U.S. It enjoys extremely stable tenant bases due to the $4,000 hurdle to move a home.

Look for increased awareness of this investment niche as high-profile industry investors, such as Buffett and Sam Zell, continue to build awareness for this sleepy, little-known investment option.

Frank Rolfe is the vice president of Cedaredge, Colo.-based MHP Investments & Leasing, the 39th largest operator of mobile home parks in the U.S. with more than 4,000 lots. Rolfe has published several books and recorded CDs on the management and turnaround of manufactured home communities with partner Dave Reynolds. You can reach Frank at www.NicheInvestmentNetwork.com.