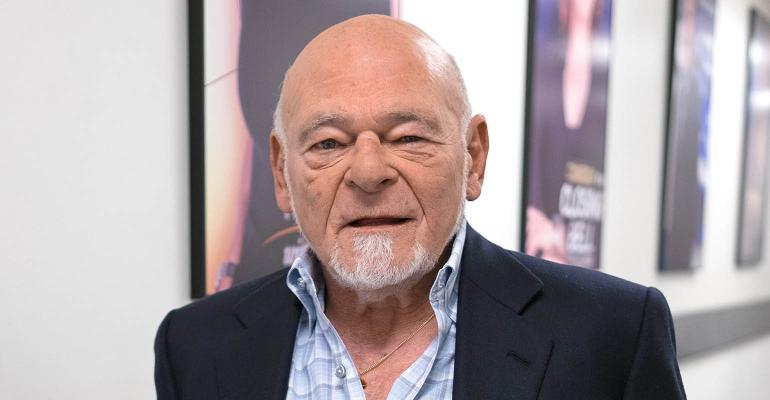

(Bloomberg) -- Sam Zell, the billionaire known for buying up troubled real estate, said the coronavirus pandemic will leave the same kind of impact on the economy and society as the Great Depression 80 years ago, with long-lasting changes in human behavior that imperil many business models.

“Too many people are anticipating a kind of V-like recovery,” Zell said in an interview with Bloomberg Television. “We’re all going to be permanently scarred by having lived through this.”

Just as the depression left behind a generation that couldn’t shake the experience of mass unemployment, hunger and desperation, the burdens this crisis has forced on society may be similarly hard to forget. Zell, 78, said it won’t be easy for people to live as they did before the “extraordinary shock” of the pandemic.

He expects some amount of social distancing and working from home to persist long after the acute phase of the outbreak is over, possibly for years. Retail, hospitality, travel, live entertainment and professional sports are some of the industries he sees continuing to struggle.

“How soon will anybody get on an airplane? How soon will anybody stay in a hotel? How soon will anybody go to a mall?” he asked. “The fact that these places may be open doesn’t necessarily mean that they’ll be doing business.”

Nothing to Buy

Zell disagrees with the conventional wisdom that big cities like New York are doomed and warehouses are the smartest bet in commercial real estate.

For now, the raspy-voiced investor who earned his nickname, the Grave Dancer, buying distressed real estate in the 1970s, is watching from the sidelines. Like Warren Buffett, Zell hasn’t found anything to buy since the onset of the pandemic. Part of the problem is a lack of deals.

“Those sellers that wanted to sell still remember the prices that were available seven or eight weeks ago. The buyers are looking at a very different world and expecting to see significant discounts,” he said. “When you’ve got that big a spread, nothing happens.”

Zell’s own investments -- concentrated in real estate and ranging from U.S. mobile-home parks to shopping centers in Latin America -- have been a mixed bag. At one project, a bridge called the Cross Border Xpress that connects California with Tijuana International Airport in Mexico, business is down 90%. Yet at U.S. hospital chain Ardent Health Services, “the impact is almost unfelt,” other than government bans on elective surgery, he said.

Every weekday morning, Zell confers with his managers on a Zoom call from his office overlooking the Chicago River. Recently, he’s been briefed on the situation at Equity Residential, his largest publicly traded company.

Shares of the real estate investment trust, one of the biggest apartment owners in the U.S., are down almost 30% since late February. Rents, however, are holding up well enough that Zell said he doesn’t expect any significant changes in monthly collections.

Oversupply Warnings

For years, Zell has been warning that the U.S. construction boom would result in oversupply and lower prices, and the current shutdown “is going to dramatically make things much worse.”

“Just like we won’t see a lot of retailers reopen,” he said, “I think we’ll see a lot of hotels that basically can’t reopen.”

When he does decide it’s time to invest, Zell will have plenty of company. Apollo Global Management Inc. is pivoting its $25 billion private-equity fund to buy distressed corporate debt. Oaktree Capital is raising a $15 billion pool to capitalize on similar situations.

“Bankruptcies are what you need to clear markets and what you need to end recessions and dips,” Zell said. “The fact that there’s a lot more distressed players today will help clear the market, but it also means that there aren’t anywhere near as many opportunities as there were in the past.”

To contact the reporter on this story:

Erik Schatzker in New York at [email protected]

To contact the editors responsible for this story:

Craig Giammona at [email protected]

Christine Maurus

© 2020 Bloomberg L.P.