The COVID-19 pandemic has impacted everyone’s lives, with far-reaching implications on the global healthcare system, financial markets and U.S. economy, including the real estate sector. Not only is this disease impacting the health and well-being of countless people around the world, it is significantly impacting the global financial markets. In mid-March, the stock market plunged to its second-lowest level on record on a percentage basis. For many workers, 401(k)s have sunk to new lows. With the U.S. stock market and equities market already feeling the pressure from the coronavirus, what does this mean to the U.S. real estate market?

Recessions and real estate

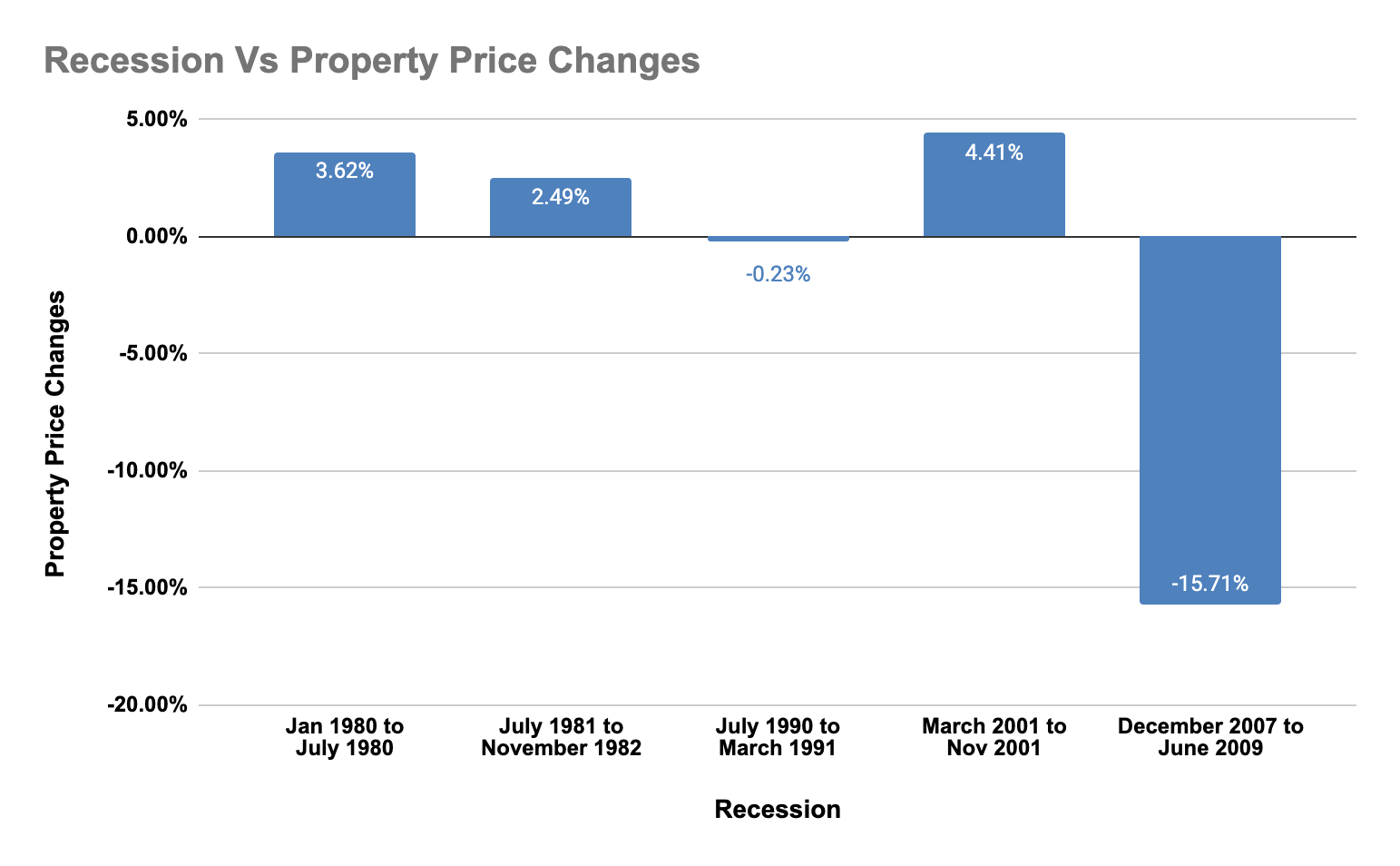

To unravel how the coronavirus will impact the U.S. housing market, we conducted a historical analysis of the five previous recessions and their impact on housing. With the exception of two recessions, the Great Recession from 2007 to 2009, and the Gulf War recession from 1990 to 1991, no other recessions have impacted the U.S housing market, according to Freddie Mac Home Price Index data collected from 1975 to 2018.

Why has U.S. real estate remained relatively sheltered from these major global events over the course of history? It’s because real estate is a safe haven for investors during times of global volatility. To that end, we analyzed how the current pandemic could lead to an economic slowdown or recession without a quick vaccine in sight. (Our data science team started researching COVID-19’s impact on the global economy in early March.) We grouped the influence of the virus into three areas: The financial markets, supply chain and property markets.

Global financial markets sell-off

For the better part of the past 30 days, the global financial markets have been reacting to a fear of the unknown. When this article was written in mid-March, the capital markets had entered correction territory, as investors rapidly sold off global and U.S. equities, wiping out a whopping $3.6 trillion in gains during the last week of February 2020.

As the capital markets continue to fluctuate wildly, investors have turned to gold as a safe place to park their cash. Goldman Sachs reported that publicly traded companies in the U.S. will generate zero earnings growth in 2020. Job losses are having a significant impact on local economies throughout the United States, with an estimated 3.4 million Americans filing unemployment claims the week ending March 21. Consumer spending will likely decline significantly in the coming months as well.

Exports and trade come to a near halt

Coronavirus fears have disrupted many global companies with supply-chain networks in China, specifically the automotive and white goods industries. Forbes reports that China produces $40 billion in auto parts annually, about half of which enters the United States for consumption. Wells Fargo states that the United States imports 20 percent of its electronics and computer parts from China. Transportation carriers have lost $350 million since China was all but closed off from the rest of the world, based on data collected in early March.

With the export market shrinking, there will be a significant slowdown in U.S. warehouse activities, resulting in contract and part-time warehouse staff layoffs. The International Energy Agency predicts a decline in global demand for oil by 435,000 barrels year-over-year in the first quarter of 2020 due to China’s moratorium on manufacturing and travel. This decrease in demand will subsequently place downward pressure on oil prices.

In all, it will take about three months--if not longer--for the U.S. consumer goods industry to feel the impact of overseas factory shutdowns due to the virus.

Retail and hospitality sectors brace for the worst

Schools, universities, major events and other public spaces have been closed and/or cancelled to reduce virus transmission. Employees throughout a majority of the country have been directed by their state governments to work from home and shelter-in-place. Business and leisure travel has also begun to shut down completely, which is already having devastating consequences on the hospitality sector worldwide. In particular, companies in the short-term rental business are fighting for survival in the wake of COVID-19. Restaurants and other retail establishments have also been forced to close down until the spread of the virus is contained.

Virus takes a toll on manufacturing

A significant decrease in the import of white goods such as appliances and building materials will affect the real estate industry as property development, repair and maintenance will slow down. This will likely have a detrimental short-term effect on real estate sales and leasing in both the residential and commercial real estate sectors. Building costs are expected to skyrocket due to supply-chain crunch on lower-cost steel products in the construction industry. There could be potential labor shortages due to construction workers becoming sick from the virus in the U.S. and abroad.

All of these factors may further limit the supply of available housing in the near term, contributing to greater demand for existing, “livable” properties. As supply continues to dwindle, additional costs could be passed on to homebuyers, investors and renters in the form of higher prices and higher rents. However, a softening economy highlighted by job losses, along with government assistance and relief funds for renters facing hardships, may counter this pricing pressure.

Investors turn to hard assets

Mortgage rates have all but bottomed to historic lows. During an emergency meeting in mid-March, the Federal Reserve just cut interest rates even further, which should make acquiring homes more affordable to a larger number of first-time buyers and first-time investors. If there ever were a time to enter the home buying market as an occupant or investor, that time is now.

During a global financial crisis, residential real estate is a safe bet as an investor since people will always need quality places to live. However, these unprecedented times have prompted a wave of panic and fear among the investment community right now. As a real estate investor, I have personally experienced other real estate downturns and I know how scary they can be. The key is to mitigate one’s downside risk and damage during these crises, and ideally position oneself to invest in more properties at lower prices in the future.

Based on a five-year average as of 2019, one million households that form may need a place to live in 2020. There is already a supply shortage of 3.8 million homes in the U.S. market creating a demand that needs to be fulfilled. The Fed has reported that economic fundamentals are strong enough to withstand the threat of the coronavirus.

Job losses and economic uncertainty may force people to continue to rent, which will bode well for real estate investors. Overall, these forces are likely to keep the housing market stable with modest growth in spite of stock market turmoil and an economic slowdown.

Doug Brien is the CEO and Co-Founder of Mynd Property Management and the former CEO and Co-Founder of Waypoint Homes, one of the first single-family rental (SFR) REITs in the U.S. Contact him at [email protected].