1 13

1 13

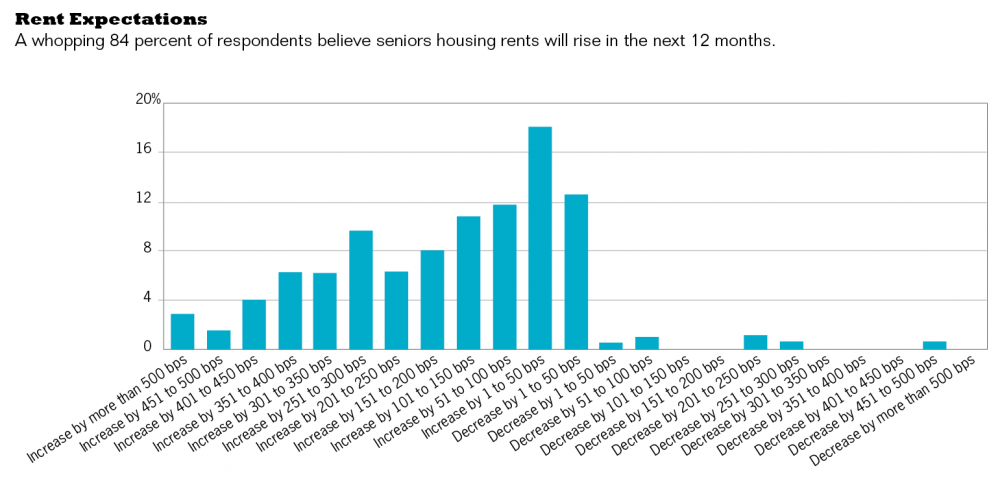

A whopping 84 percent of respondents believe seniors housing rents will rise in the next 12 months. In total, the expectation is that rents will rise by about 150 basis points.

Respondents do not expect to see underwriting standards change much in the next 12 months.

Respondents do not expect the deal closing times to change much in the next 12 months. Overall, nearly three-quarters of respondents expect the time it takes to close a deal to remain the same. Only 9 percent expect to see deals close faster.

Respondents were asked to rank eight different funding sources. REITs are seen as the most significant source of debt capital for the sector followed closely by Fannie/Freddie.

Respondents were asked to what extent four factors had affected the occupancy rates at seniors housing facilities in the past six months. The state of the economy and new, competing facilities were seen to have the biggest impact.

Respondents expect construction starts to rise in the next 12 months. Overall, 69 percent say starts will increase. Only 8 percent expect them to decrease somewhat.

That's virtually the same as last year when 73 percent expected starts to increase.

Respondents expect demand for seniors housing to remain strong in the next 12 months. Most (71 percent) expect occupancies to increase. Overall, 27 percent of respondents expect occupancies to move by 1 to 25 basis points. The mean for all respondents calls for a 25.7 basis point increase in the next 12 months.

Very few respondents expect to see the volume of property sales drop in the next 12 months. Overall, 53 percent expect volume to rise and another 40 percent expect it to remain flat.

Respondents expect both debt and equity capital to be as available or more available in the next 12 months.

Respondents see interest rates as the most likely aspect of seniors housing finance to change in the next 12 months.

Nearly half of respondents (47 percent) expect cap rates to increase, with most expecting them to move up by 50 basis points or less. The mean for all respondents suggests cap rates will rise by about 15 basis points in the next 12 months.

Not surprisingly, respondents to the survey see seniors housing as the most attractive property type, slightly edging apartments.

Respondents do not expect the current level of construction to result in overbuilding.