- Brexit and Bubbles: How Investors View Europe’s Shaky Real Estate Market “For the first time in three years, foreign investors poured more money into U.S. real estate assets than European property last year. The change marked a shift for investors who had been drawn to Europe’s ultra-low interest-rate environment, which has fueled an overvalued commercial market and a housing boom that could be approaching a bubble.” (The Real Deal)

- These Retailers Could Be Winners as Pier 1 Shuts 50% of its Stores “The retailers that stand to benefit from Pier 1′s demise, more than others, are Wayfair, HomeGoods, Target and At Home, according to an analysis by Telsey Advisory Group. While Wayfair operates primarily online, a geographical study by Telsey found that 60% of At Home’s stores, 59% of HomeGoods’ stores and 35% of Target’s stores have a Pier 1 location within three miles.” (CNBC)

- As West Coast Transplants Pour In, a Small Idaho Town Has a Big Dilemma “When JT and Mary Jo Turnipseed moved to this sleepy town of 6,000, they thought they had found the perfect place to retire from the stress of Southern California. They loved the smell of mint that drifted in from the farms, how neighbors knew each other by name and the general store that reminded them of the small Iowa town where they had both grown up. That was six years ago. Since then, Star, about 30 minutes west of Boise, has become the fastest-growing city in Idaho—one of the fastest-growing states in the nation.” (Wall Street Journal, subscription required)

- CRE Was Strong Last Year, But Can 2020 Keep Up? “Strength in the US and core markets in Asia are driving growth in commercial real estate transactions according to a new report. JLL’s research shows that 2019 was an impressive year for CRE transaction volume globally, with a new record high of U$800 billion. But there are ongoing headwinds from political uncertainty and the slowing global economy.” (Mortgage Professional America)

- Real Estate Money Still Rolling In for Senate Dems Despite Vows from Some to Avoid the Industry “It’s just not that easy to get money out of politics. Last year, as New York lawmakers overhauled the state’s rent laws, some progressive Senate Democrats swore off real estate money and vowed to keep their main account free of funds from landlords. But dismissing dollars from deep-pocketed donors is proving difficult as a handful of moderate Dems continue to accept contributions from those with ties to the industry.” (New York Daily News)

- Philadelphia Refinery Expected To Be Sold to Real Estate Developer “The bankrupt Philadelphia Energy Solutions is expected to sell its fire-damaged refinery site to real estate developer Hilco Redevelopment Partners, three sources familiar with the situation said on Tuesday. The agreement between PES and Hilco, a Chicago-based developer, is expected to be announced later on Tuesday. PES and Hilco did not immediately respond to requests for comment. A city official declined to comment.” (Reuters)

- Property Values, and Thus Property Taxes, Are Rising “The rise in property values in Arlington is accelerating post-HQ2. Late last week Arlington County announced that its assessments for 2020 had risen 4.6% on average — 4.9% for commercial properties and 4.3% for residential properties. That compares to an average property assessment increase of 3.5% last year. The rise in property values will almost certainly mean a rise in property taxes for Arlington residents.” (ARL Now)

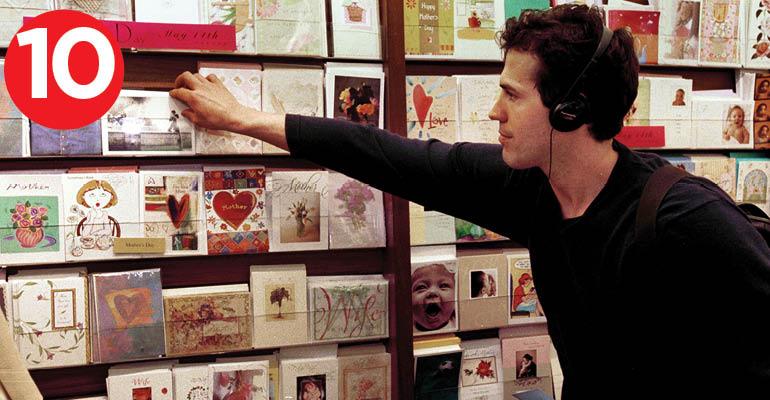

- Greeting Card Retailer Papyrus Is Closing All Stores “Greeting card and gifts chain Papyrus is closing all its stores, including six in Illinois, according to employees at two Chicago-area stores. The employees said they were told last week that all stores were expected to close in the next four to six weeks. Closing sales have already begun in stores and online, the employees said. Parent company Schurman Retail Group, based in Tennessee, could not immediately be reached for comment and has not publicly announced closures.” (Chicago Tribune)

- Miami’s Million-Dollar Communities Dipped in Home Values in 2019. Here’s Why “The wealthiest neighborhoods in the Miami metro area remain on a list of U.S. cities with average home prices over $1 million while others elsewhere landed on the cutting floor. But with a dip in home values, could Miami be next on the chopping block? Seven areas in South Florida have an average home value over $1 million — five in Miami-Dade and two in Palm Beach County.” (Miami Herald)

- Sheldon Silver’s Corruption Conviction Is Partially Overturned “A federal appeals court on Tuesday partially overturned the 2018 corruption conviction of Sheldon Silver, once the powerful speaker of the New York State Assembly, but allowed much of the conviction to stand — likely ending his hopes of remaining out of prison. Mr. Silver, a Democrat from Manhattan’s Lower East Side, had been sentenced to seven years in federal prison for accepting nearly $4 million in illicit payments in return for taking official actions on behalf of a cancer researcher and two real estate developers.” (The New York Times)

0 comments

Hide comments