(Bloomberg)—Explore what’s moving the global economy in the new season of the Stephanomics podcast. Subscribe via Pocket Cast or iTunes.

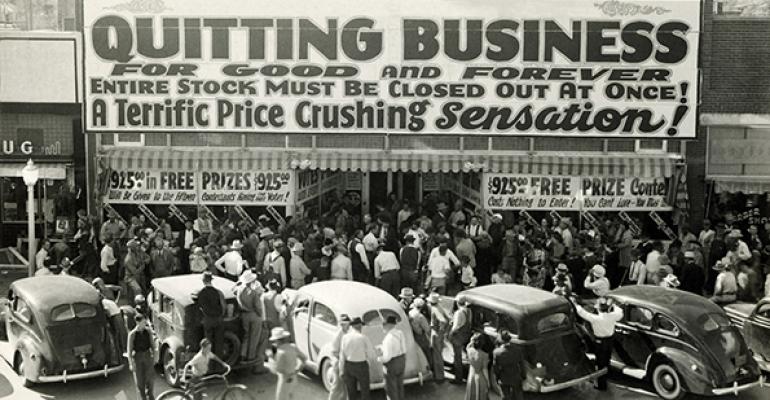

U.S. retail store closures in 2020 are at risk to be just as bad -- or even worse -- than 2019, according to a Credit Suisse report.

Domestic closures are trending to all-time record highs, led by the Softlines, also known as apparel or textiles, according to Michael Binetti and other Credit Suisse analysts.

There have been 7,600 U.S. store closures announced in 2019 to date, representing the highest number of closures ever at this point in the year, according to the firm’s 24-year-old U.S. Retail Store Closure Index. Around 75% of those stores are Softlines.

There are multiple reasons for this trend, according to the report. “Softlines spending has deteriorated as retailers struggle to lap a tax reform-driven step-up in 2018 discretionary spending.” In addition, there have been “powerful changes” in purchasing habits in this category, including the growing popularity of the online luxury-goods consignment shop The RealReal Inc., the rental space with players like Rent the Runway Inc., and a “continued push towards all things digital” seen at the Revolve Group Inc. The result is added pressure to already-challenged traffic trends at “over-stored” brick and mortar retailers.

With these trends in play, the analysts said they believed it would be “increasingly tough for Softlines retailers to justify keeping underperforming stores open, and wouldn’t be surprised to see another large-scale round of closure announcements in early 2020.”

Some mall-based names most at risk for larger scale closure announcements include Macy’s Inc., J.C. Penney Company Inc., Gap Inc. and L Brands Inc.’s Victoria’s Secret, the report said. Binetti rates Gap, L Brands and Macy’s neutral, and has an underweight rating on J.C. Penney.

To contact the reporter on this story: Janet Freund in New York at [email protected].

To contact the editors responsible for this story: Catherine Larkin at [email protected]

Jennifer Bissell-Linsk

© 2019 Bloomberg L.P.