Simon Property Group Inc. shocked the market this morning when it announced it had exercised its contractual rights to terminate its merger agreement with Taubman Centers.

Simon also filed an action today in the Circuit Court for the 6th Judicial Circuit of Oakland County, Michigan against Taubman Centers and The Taubman Realty Group L.P. "requesting a declaration that Taubman has suffered a Material Adverse Event under the Merger Agreement and has breached the covenants in the Merger Agreement governing the operation of Taubman's business."

Taubman responded to Simon's move in the afternoon, confirming receipt of notice and responding by calling the termination "invalid and without merit."

According to a release, "Taubman intends to hold Simon to its obligations under the Merger Agreement and the agreed transaction, and to vigorously contest Simon’s purported termination and legal claims. Taubman intends to pursue its remedies to enforce its contractual rights under the Merger Agreement, including, among other things, the right to specific performance and the right to monetary damages, including damages based on the deal price."

Taubman added that a meeting of shareholders to approve the deal scheduled for June 25 will proceed as planned.

Taubman's stock fell 20 percent during the day on the heels of the news, closing at $36.16 per share. Simon's stock fell 4 percent, to $83.01 per share.

Simon is terminating the deal based on two grounds.

According to its release, "First, the COVID-19 pandemic has had a uniquely material and disproportionate effect on Taubman compared with other participants in the retail real estate industry. Second, in the wake of the pandemic, Taubman has breached its obligations, which are conditions to closing, relating to the operation of its business. In particular, Taubman has failed to take steps to mitigate the impact of the pandemic as others in the industry have, including by not making essential cuts in operating expenses and capital expenditures.""

Simon also cited that that the merger agreement specifically gave Simon the right to terminate the transaction in the event that a pandemic disproportionately hurt Taubman. Taubman's significant proportion of enclosed retail properties located in densely populated major metropolitan areas, dependence on both domestic and international tourism at many of its properties, and its focus on high-end shopping have combined to impact Taubman's business disproportionately due to the COVID-19 pandemic when compared to the rest of the retail real estate industry. In addition, Taubman has breached its obligation to operate its business in the ordinary course."

COVID-19 shutdowns have been incredibly damaging for the regional mall sector. Many malls in the country were shut down for extended stretches starting back in March. Simon, for example, closed all of its malls back on March 18. Many properties have reopened, but foot traffic has been much lower.

An analysis by the CoStar Group, a provider of real estate data, shows that some of the largest high-risk retailers occupy a hefty share of mall space across the country. Fourteen of the 20 largest mall tenants are either apparel retailers or department stores, and these 14 tenants occupy almost one-fourth of regional and super regional mall space in the U.S., the analysis shows.

Rent collections have also plummeted, with the percent of tenants paying rent for some mall companies dropping to the 25-percent range. In a potential sign of battles to come, Simon last week sued Gap over unpaid rent and other charges amounting to $66 million.

Experts are forecasting that retail rents will decline by more than 10 percent by the end of the year.

Taubman signaled it was playing hardball with its tenants back in March.

In the first quarter—for much of which its properties were operating normally--Simon reported funds from operations (FFO) of $980.6 million, or $2.78 per diluted share, as compared to $1.082 billion, or $3.04 per diluted share, in the prior year period.

In response to COVID-19, the REIT implemented a series of measures, including reducing non-essential corporate spending and property operating expenses; implementing a temporary furlough of certain corporate and field employees; suspending or eliminating more than $1.0 billion of redevelopment and new development projects; reducing compensation for Chairman, CEO and President David Simon to a base salary of zero and deferred his approved 2019 bonus; temporarily decreasing the base salary of certain of its salaried employees ranging from 10 percent to 30 percent; suspending payments to board members and drawing down $3.75 billion from its revolving credit facilities.

The company has also signaled that a 50 percent cut in its shareholder dividend may be coming.

Meanwhile, Taubman reported adjusted FFO per diluted share of $0.88, down $0.07 for the quarter ended March 31, 2019.

Because of the pandemic, the REIT closed all but two of its U.S. shopping centers on March 19 with the other two shutting shortly after that.

In March, the company deferred between $100 and $110 million of planned capital expenditures. It also reduced operating expenses by $10 million for the year. It also announced last week that it would not declare a second quarter dividend on its common stock.

It's just the latest high-profile deal to fall apart in the wake of COVID-19. The only reported larger commercial real estate transaction to fall apart was South Korea’s Mirae Asset Global Investments deal with Chinese insurance giant Anbang to buy its portfolio of 15 luxury hotels in major U.S. cities including New York and San Francisco for $5.8 billion.

This is just the latest twist in a long history of drama between the two firms, as NREI recapped back in February:

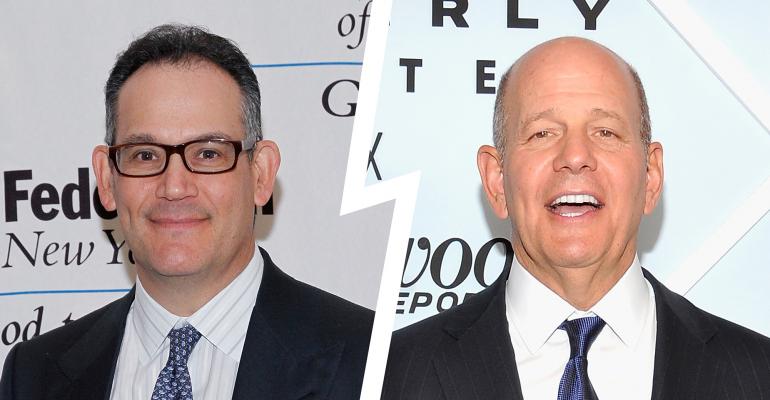

Taubman dates back to 1950 when A. Alfred Taubman created the company. While Simon was founded about a decade later by brothers Melvin and Herbert Simon as Melvin Simon & Associates. Today Taubman’s sons Robert S. Taubman, the REIT’s chairman, and president and CEO, and William S. Taubman, COO, head up Taubman while Melvin’s son David Simon is chairman and CEO of Simon Property Group.

But at a low point, Simon attempted a hostile takeover of Taubman Centers in 2002 while company founder A. Alfred Taubman was briefly behind bars due to a price-fixing scandal at Sotheby’s, which he owned at the time.

In his memoir, published in 2007, Taubman wrote about how much the takeover attempt stung him. “In the business world, it used to be true that family businesses didn't attack other family businesses,” Taubman wrote at the time. “So much for history. Simon had locked itself into an acquire-or-die strategy and saw us as easy prey.”

Now nearly 20 years later the narrative is quite different. The two families see a brighter future ahead with Taubman’s smaller portfolio of high-quality centers benefiting from Simon’s scale in the marketplace.

As a result of the deal, the Taubman family will sell roughly one-third of its ownership stake at the transaction price and retain 20 percent ownership in Taubman Realty Group L.P. Taubman will continue to be managed by Robert S. Taubman in partnership with Simon.

“Over the last few years, David and I have developed an excellent personal relationship and importantly, Simon shares our commitment to serving retailers, shoppers and the communities in which we operate,” Robert S. Taubman said in a statement. “The board and I are confident that Simon is the ideal partner to help us build on our progress."