1 14

1 14

Today’s leading occupiers realize that environmental responsibility is not only essential to business operations, but can also enhance a corporation’s brand and customer appeal.

Global Real Estate Sustainability Benchmarks (GRESB), a private, European-based group, is the second-largest driver for sustainability measures, following business management best practices. The media and the environment tied as third-place drivers.

Large multinationals typically have formal social responsibility programs in place to address the environmental concerns of their shareholders and employees.

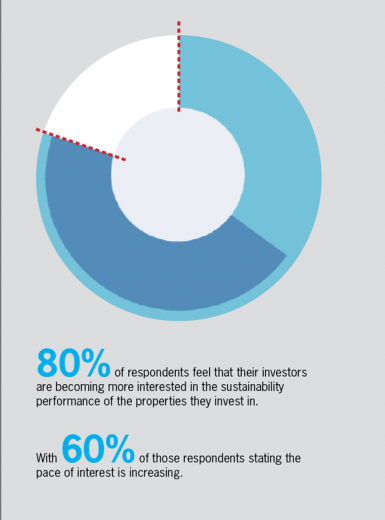

Investors are demanding real estate managers address sustainability in evaluating new investments, with 72 percent of those surveyed stating they have established policies at the fund level. Respondents also perceived sustainability performance to have a positive correlation to value.

While value varies from market to market, sustainability’s impact can be significant in making a property more competitive and assisting in a more rapid lease-up. While 72 percent of respondents say they evaluate the sustainability of an investment during acquisition, 53 percent of respondents admit that their methodology for doing so is inconsistent.

While sustainability looms large in new acquisitions and development, that's not the case with established portfolios: 80 percent of respondents say they do not evaluate the sustainability of what they already own.

The value difference between a sustainable and non-sustainable building is notable, according to 76 percent of the respondents.

However, while the majority of respondents say that there is a value difference between sustainable and non-sustainable buildings, or LEED-certified and non-LEED-certified buildings, only 16 percent of respondents feel that sustainability contributes directly to rental premiums.

Benchmarking and energy conservation systems are the top contributors to a sustainable property's value.

Sustainable building management initiatives like recycling, lighting and lowering carbon emissions matter as much as MEEP and security. Curiously, while cleaning and HVAC come in second, air quality is rated last, along with federal and municipal subsidies for implementing sustainability measures.

If a sustainability building isn't performing well, should an owner sell it? Most owners say no (64 percent), but approximately a third (28 percent) say yes, while 8 percent aren't sure.

In 2012, corporate sustainability was being included at the fund level in 100 percent of European property owners; in 2013, American property owners still lag behind at 72 percent.

While 100 percent of Europeans had consistent methodology in underwriting in 2012, American respondents state that their methodology is inconsistent.

By the end of 2012, 45 percent of European property managers had implemented minimum performance standards, compared with just 15 percent of American property managers in 2013.