More than six months into the 2020 recession caused by the global health crisis, questions at the forefront for commercial real estate are how much investors dial back their economic outlook, property performance expectations and their plans to invest more capital. Yet the latest edition of the NREI / Marcus & Millichap Investor Sentiment Survey yields a surprising mix of both positive and negative views.

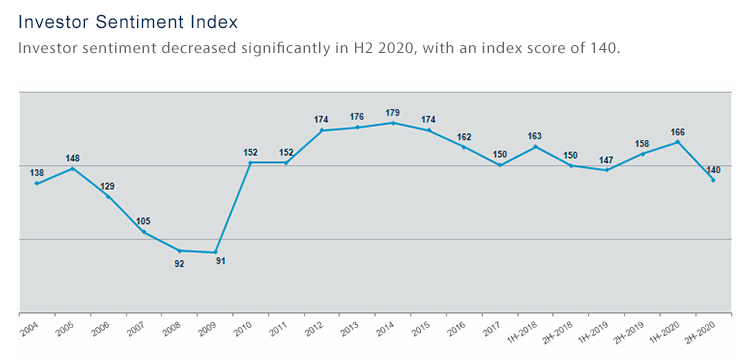

The Investor Sentiment Index has proved to be a reliable barometer for views on the commercial real estate industry across its more than 16-year history. Investor sentiment dropped sharply from 166 just ahead of the pandemic in the first half 2020 survey to 140 in the current second half survey that polled industry participants in late-August [Figure 1]

Although the Index now stands at a 10-year low, it remains well ahead of sentiment during the 2008-2009 recession when Index levels fell below 100. The decline in sentiment was expected given the havoc the coronavirus pandemic has wreaked on the U.S. and global economies. However, the Index remains surprisingly high given the severity of the impact. In fact, the current level is just slightly below the peak of 148 reached during the last cycle in 2005.

Digging into the granular survey results suggests that it is difficult to paint the entire commercial real estate market with a single brush. “The factor weighing most heavily on sentiment is the uncertainty surrounding the pandemic and the economy, and these issues are affecting some property types a lot more than others,” says John Chang, senior vice president of research services at Marcus & Millichap. Survey respondents continue to have a favorable outlook for some sectors and more pessimistic views on others. Specifically, property values over the next 12 months are anticipated to rise by an average of 5.7 percent for industrial, 5.6 percent for self-storage, 5.1 percent for apartments and 3.0 percent for seniors housing. At the same time, there is greater concern for eroding values in other sectors, with hotels expected to see the biggest weakening of 7.7 percent, followed by retail at 6.8 percent and office by 5.0 percent [Figure 2].

“There is a lot of variance by property type and also by geography,” says Chang. At the same time, survey responses regarding whether it is a better time to buy, hold or sell assets indicates that many investors see new opportunities, he adds. Views were widely mixed when all respondents were asked whether they thought it was a better time to buy, hold or sell properties across different sectors. In most cases, a bigger number of respondents said it was better to hold. However, several sectors demonstrated strong buyer sentiment including industrial at 49%, office and seniors housing each at 41 percent, and apartments at 38 percent. Those property types that rated low for buyer interest were self-storage at 12 percent, retail at 13 percent and hotels at 19 percent.

When the same question was asked only of those investors who already actively invest in the particular property type, favorable views on buying increased for industrial and seniors housing to 60 percent and 59 percent respectively. Views on buying apartments or office were comparable with 42 percent for each who thought it was a good time to buy more. Fewer thought it was a better time to buy hotels (27 percent), retail (16 percent) or self-storage (13 percent). “Investors see opportunities ahead for several property types, but there is still a lot of caution surrounding others. So, the real estate market is a very fragmented right now,” says Chang.

Survey Methodology: National Real Estate Investor’s research unit, Informa Engage, and Marcus & Millichap emailed invitations to participate in this online survey to public and private investors and developers of commercial real estate. Recipients of the survey included Marcus & Millichap clients as well as subscribers of NREI selected from commercial real estate investor, pension fund, and developer business subscribers who provided their email addresses. The survey was conducted between August 20-30 with 691 completed surveys received. Survey respondents represent a broad cross-section of industry respondents that include private investors, developers, advisors, lenders and REITs among others. The largest percentages of respondents are private investors at 38 percent, developers at 12 percent and private partners and financial advisors each at 11 percent. Respondents are invested in a variety of property types with a majority of 63 percent invested in apartments, followed by retail at 36 percent and office and industrial each at 32 percent. On average, respondents have $41.4 million invested in commercial and/or multifamily property.