Continuing a trend that began late last year, regional mall REITs reported improving fundamentals in the third quarter of 2010, including increases in occupancy and some upward movement in tenant sales. Of the six regional mall players currently tracked by analysts (the seventh, General Growth Properties has just emerged from bankruptcy protection and as such, hasn't received analyst coverage), three beat consensus analyst estimates, two were in line with expectations and only one missed.

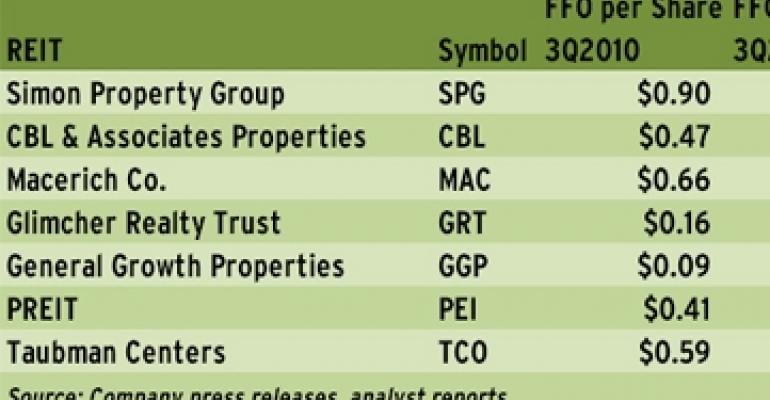

The outperformers included Macerich Co., CBL & Associates Properties and PREIT, which beat analyst FFO estimates by a range of $0.01 to $0.03 per share. Simon Property Group and Glimcher Realty Trust were in line with expectations. Taubman Centers missed consensus by $0.08 per share.

Even so, according to Rich Moore, an analyst with RBC Capital Markets, the pace of growth for REITs has slowed in the third quarter, as the U.S. economic recovery lost some steam. "The excitement evident in first half of 2010... has given way to a more subdued environment," he wrote.

The good news is that the consumer still forges ahead, albeit with much caution. Most of the regional mall REITs reported increases in tenant sales per square foot in the third quarter compared to a year ago, ranging from 2.6 percent all the way to 13.2 percent (for Taubman). As a result, all seven operators experienced occupancy increases.

And same-store NOIs rose for at least four of the REITs. General Growth Properties and PREIT reported slight NOI decreases, at 1 percent and 1.5 percent respectively. Taubman does not track same store NOI.