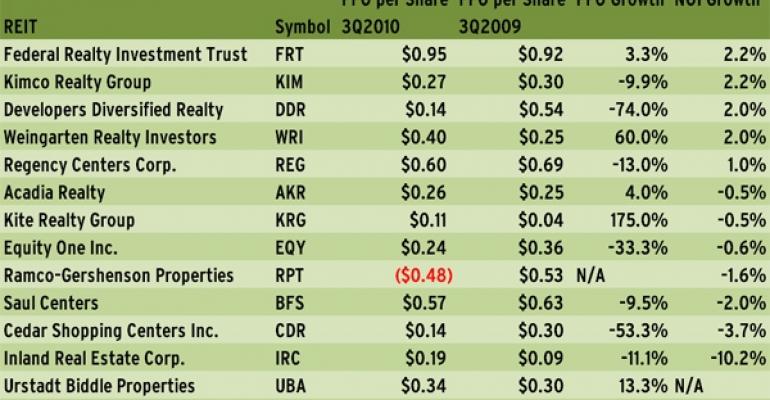

Now that all 13 shopping center operators in the REIT universe have posted results for the third quarter of 2010, it looks like the sector continues to have good momentum heading into 2011. Some of the operating metrics were not as strong as those of the regional mall players--occupancies decreased for at least four of the REITs and NOI growth was positive for only half of the shopping center landlords. But all in all, fundamentals are looking up.

Five shopping center REITs outperformed analysts' FFO expectations in the third quarter, by a range of $0.01 per share to $0.04 per share. The outperformers included Kimco Realty Corp., Regency Centers Corp., Weingarten Realty Investors, Ramco-Gershenson Properties Trust and Urstadt Biddle Properties. Seven companies missed estimates, most by only $0.01 to $0.02 per share. These included Developers Diversified Realty, Federal Realty Investment Trust, Cedar Shopping Centers, Saul Centers Inc., Acadia Realty Trust, Inland Real Estate Corp. and Equity One Inc.

Kite Realty Group was right on target.

With the exception of Equity One, portfolio occupancies in the sector stayed well above 90 percent.

"We continue to believe that the retail REIT universe will continue to enjoy steady earnings growth in 2011 and 2012," wrote Rich Moore, REIT analyst with RBC Capital Markets in a Nov. 12 report.