Like their counterparts in the mall sector, shopping center REITs delivered a respectable performance in the second quarter of the year.

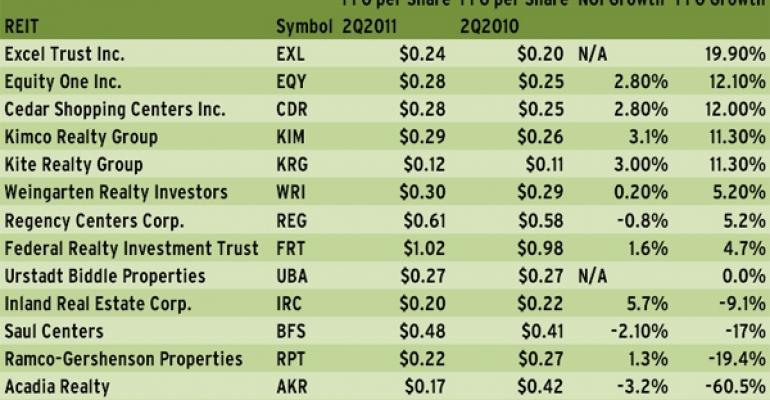

Out of 18 shopping center REITs, six beat consensus analyst estimates for FFO per share and three were in line with expectations. The outperformers included Kite Realty Group, Weingarten Realty, Equity One Inc., National Retail Properties and Federal Realty Investment Trust. Inland Real Estate Corp., Cousins Properties and Ramco-Gershenson Properties Trust performed as expected.

On the other hand, nine shopping center REITs missed estimates on FFO per share, mostly by a few pennies. These included Cedar Shopping Centers, Urstadt Biddle Properties, Saul Centers, Acadia Realty Trust, Amercian Assets Trust, Regency Centers Corp., Kimco Realty Corp., and Whitestone REIT.

Developers Diversified Realty, however, missed by $0.13 per share, partly as a result of charges related to the REIT's efforts to sell off non-core assets.

On the whole, however, occupancies in most cases were well north of 90 percent and same-store NOIs continued to grow. According to today's note from RBC Capital Markets' analyst Rich Moore:

Operating metrics were generally positive across the retail real estate sector with no signs of an economic slowdown. Leasing velocity remains near record pace, move-outs are nearing their lows, bankruptcies are almost non-existent, bad debt is at an unusually low level, rent terms are normalizing, and, perhaps most importantly, tenant demand for space at the best centers has not abated.

Likewise, David Henry, president and CEO of Kimco Realty Corp., one of the country's largest shopping center REITs, said he was pleased with the company's performance in the second quarter of the year and with the general trends evident in the marketplace when discussing results with analysts on July 27.

Overall, we are confident and optimistic about the balance of the year and our full year operating results, he said.