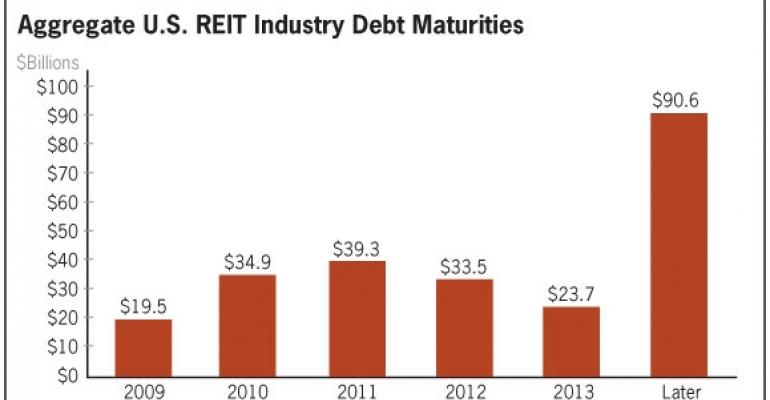

The issue of REIT debt maturities continues to hang over the industry. Companies with high debt loads such as General Growth Properties and Centro Properties Group have had well-publicized problems. Other firms have been able to deal with debt maturities and line up refinancing. Recent stats from SNL Financial (and courtesy of JP Morgan) illustrate the extent of the issue.

Overall, REITs have $19.5 billion in debt maturities in 2009 along with $34.9 billion in 2010 and $39.3 billion in 2011. Regional mall REITs—largely because of General Growth's debt load—are the most highly indebted, carrying $39.7 billion in debt.

0 comments

Hide comments