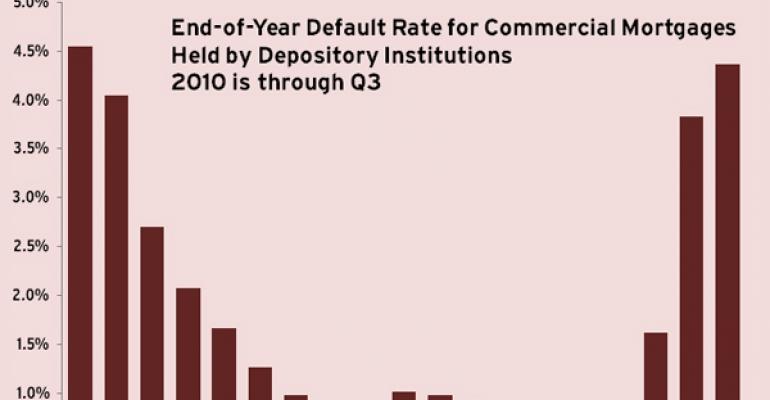

- Banks’ commercial real estate default rate increased to 4.36 percent in the third quarter. The rate rose by just 9 basis points, one of the smallest increases since the market downturn began. In contrast, the average quarterly increase in the siz quarters starting in the fourth quarter 2008 was 47 basis points.

- By volume, $604 million in commercial mortgages entered default in the third quarter, up from $518 million in the second quarter. However, it was just the second quarter since the end of 2007 during which the volume of new defaults was less than $1 billion. In contrast, $7.1 billion of mortgages entered default in the second quarter of 2009 alone.

- The balance of banks’ commercial real estate mortgages in default stands at $46.8 billion on a total loan blance of $1.07 trillion. Of that, $11.6 billion is 30 to 89 days past due, $4.8 billion is 90+ days past due and $41.9 billion is in non-accrual status.

- Year-over-year, the default rate on commercial properties rose 0.95 percent--the smallest 12 month gain since the period between the fourth quarters of 2007 and 2008.

- Legacy issues are constraining new lending by banks, even as life companies and other large institutional lenders increase activity in major markets. Banks’ total commercial real estate balance sheet has declined by $8.8 billion in the third quarter and by $18.5 billion year-to-date.

Source: Real Capital Analytics

0 comments

Hide comments