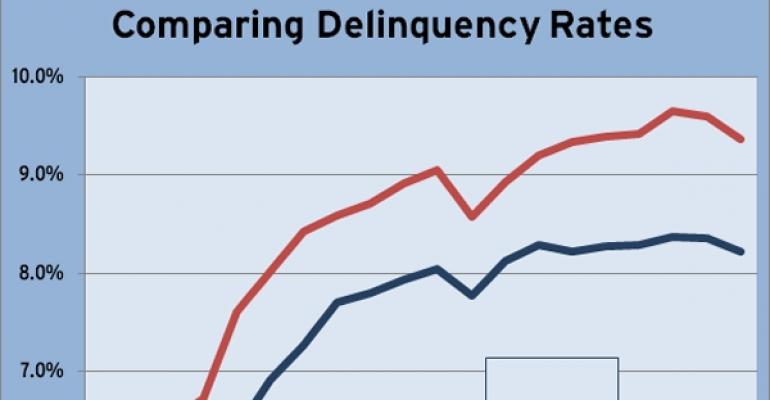

- Morningstar’s rate stands at 8.22 percent while Trepp’s rate is 9.37 percent.

- Morningstar counts $60.86 billion in CMBS loans as delinquent. Of that, $5.92 billion is 30 days past due, $4.24 billion is 60 days past due, $24.04 billion is 90 or more days past due, $14.74 billion is in foreclosure and $11.92 billion is REO.

- Trepp counts the percentage of loans that are seriously delinquent (60+ days past due or greater) as 8.75 percent, down 21 basis points from May 2011. Of the overall CMBS universe, Trepp counts 0.62 percent as 30 days delinquent, 0.57 percent as 60 days delinquent, 2.70 percent as 90 or more days delinquent, 0.72 percent as nonperforming matured balloon, 2.93 percent in foreclosure and 1.83 percent is REO.

- One of the biggest differences between the two firms comes in looking at the multifamily sector. Morningstar counts the multifamily delinquency rate as 9.5 percent while Trepp reports it at 16.5 percent. Numbers for industrial (Morningstar: 10.9 percent, Trepp: 11.7 percent), lodging (Morningstar: 12.2 percent, Trepp: 13.9 percent), office (Morningstar: 7.0 percent, Trepp: 7.4 percent) and retail (Morningstar: 7.3 percent, Trepp: 7.8 percent) are more in line with each other.

Sources: Morningstar Credit Ratings, Trepp

0 comments

Hide comments