The Moodys/REAL commercial property index showed steep price drops across all commercial property types during the first quarter. Overall, commercial real estate prices fell 8.6 percent—the steepest drop in the index, which tracks data back through 2000.

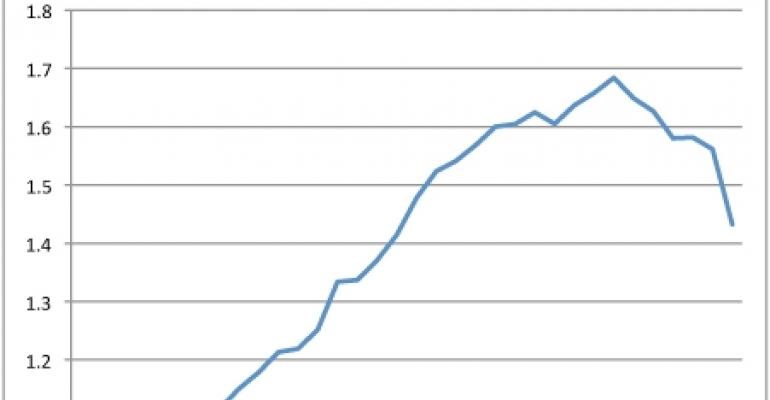

The retail index fell to 1.43 in the first quarter—the lowest level since the fourth quarter of 2004. (A score of 1.00 represents where prices were as of the fourth quarter of 2000.) The index peaked at 1.68 in the third quarter of 2007. In the five quarters following the peak the index fell by an average of 0.02 points per month. The drop from the fourth quarter of 2008 to the first quarter of 2009, however, represented a 0.13 point drop in the index.

The report’s authors attribute the steep drop to the fact that owners are beginning to accept declines in commercial property values and have begun to put more distressed assets on the market.

The Moodys/REAL commercial property index (CPPI) is a periodic same-property round-trip investment price change index of the U.S. commercial investment property market based on data from MIT Center for Real Estate's partner Real Capital Analytics. The methodology for index construction has been developed by the MIT/CRE through a project undertaken in cooperation with a consortium of firms including RCA and Real Estate Analytics, LLC.