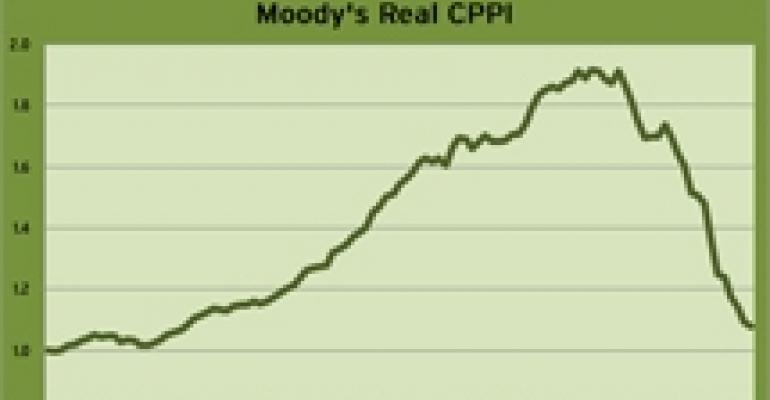

The Moody’s/REAL Commercial Property Price Index measured a 1.5 percent decline in prices in October. The National All Property Type Aggregate Index now stands 36.4 percent below the level seen one year ago. The peak in prices was reached two years ago, in October 2007, and prices have since fallen 43.7 percent.

A score of 100 on the index equates to average commercial real estate property prices in the fourth quarter of 2000. The index stands at 108 through the end of October. Its peak level was 192 in October 2007.

Commercial real estate prices are now back to September 2002 levels. However, the pace of the price declines has slowed in recent months. The 1.5 point drop from September to October was the smallest decrease in more than a year.

Moody's also produces quarterly indexes by property type. Through the third quarter, the retail property price index stood at 142--a four point increase over the prior quarter.

The retail index peaked at 195 in the third quarter of 2007. The retail numbers are the strongest of the four property types Moody's monitors. The industrial index is at 121, the apartment index is at 118 and the office index is at 113. Retail is down 23 points from two years ago--a smaller drop than for industrial (30 points), apartments (35 points) and office properties (38 points).

By region, the index for West retail stands at 151, for East at 134 and for the South at 158.