- Multifamily mortgages in default are $10.1 billion.

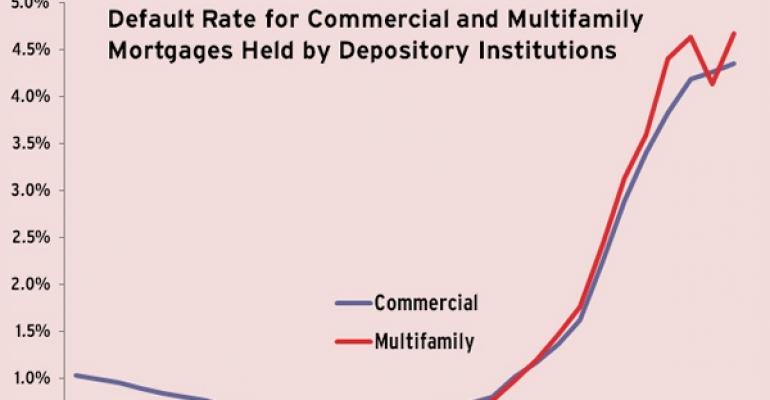

- The multifamily default rate increased sharply between the second and third quarters, jumping from 4.13 percent to 4.67 percent.

- Between the first and second quarter, the multifamily default rate had fallen by 50 basis points, the first such decline of the cycle, raising hopes that the bank stress related to real estate exposures might have reached its inflexion point.

- Over the course of downturn, the increase in the default rate for multifamily mortgages has been more dramatic than for commercial real estate. The current multifamily default rate is nearly 20 times higher than the 0.24 percent default rate measured in the first and second quarters of 2005.

- Banks’ exposure to the multifamily sector is more limited, however, with total outstanding balances of $215.8 billion and mortgages in default of $10.1 billion.

Source: Real Capital Analytics

0 comments

Hide comments