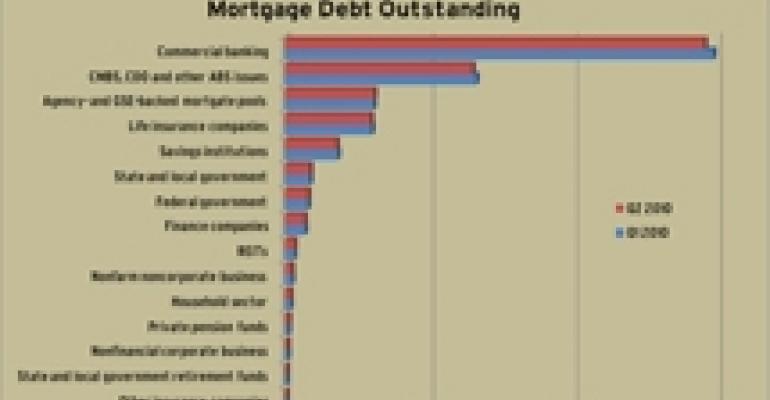

The latest review of the Federal Reserve Board’s Flow of Funds data by the Mortgage Bankers Association reveals that the level of commercial/multifamily mortgage debt outstanding decreased in the second quarter, to $3.24 trillion

The declines were driven by drops in commercial and multifamily mortgages held in CMBS and loans held by banks and thrifts. Overall, mortgage debt outstanding declined by $52 billion from the first quarter, a 1.6 percent drop.

“Demand for commercial and multifamily mortgages, while increasing, remained weak in the second quarter and contributed to the continuing trend of loans paying down and paying off faster than new ones replace them,” Jamie Woodwell, MBA’s vice president of commercial real estate research, said in a statement. “As a result, the balance of mortgage debt outstanding declined for every major investor group with the exception of Fannie Mae’s, Freddie Mac’s and FHA/Ginnie Mae’s multifamily portfolios and MBS.”

Commercial banks continue to hold the largest share of commercial/multifamily mortgages, at $1.46 trillion, or 45 percent of the total.

According to the MBA, “Many of the commercial mortgage loans reported by commercial banks however, are actually ‘commercial and industrial’ loans to which a piece of commercial property has been pledged as collateral.” Overall, MBA estimates that 48 percent of the aggregate balance among the top 10 commercial real estate bank lenders, excluding the multifamily sector, is related to owner-occupied properties.

In the second quarter, the outstanding balance of commercial/multifamily mortgage debt at commercial banks decreased by $30 billion, a 2 percent drop compared with the first quarter. Meanwhile, CMBS, CDO, and other ABS issues decreased their holdings of commercial/multifamily mortgages by $14 billion or 2 percent.