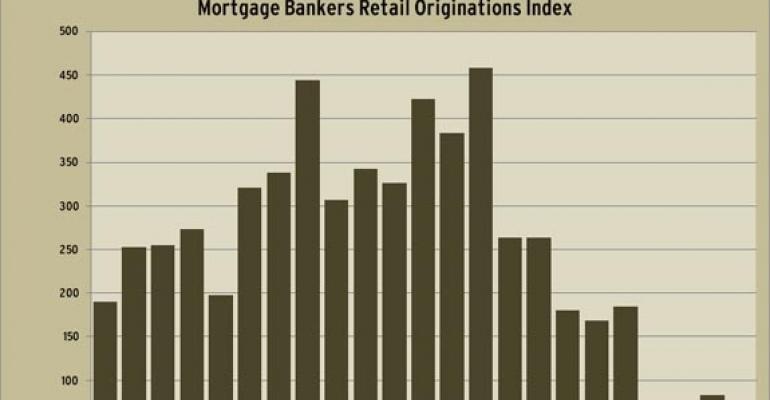

The Mortgage Bankers Association's Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations showed that the volume of retail loans was down slightly in the third quarter compared with the quarter prior.

For all property types, the index came in at a reading of 53--down from 60 in the second quarter. It was the fourth straight quarter with a reading below 60. A reading of 100 equates to the volume of an average quarter in 2001.

For retail properties, the index came in at 71--down slightly from the reading of 83 in the second quarter, but greater than the readings of 43 and 47 posted in the first quarter of 2009 and the fourth quarter of 2008. The index for retail properties was at 185 during the third quarter of 2008.

As for loan sizes, the average retail deal came in at $10.8 million. That was down from $16.7 million in the second quarter and $110.0 million in the first quarter but greater than the $7.5 million average posted in the fourth quarter of 2008.

"Tight credit conditions coupled with scant demand for new loans meant that commercial and multifamily mortgage originations remained low in the third quarter," said Jamie Woodwell, MBA's vice president of commercial real estate research in the MBA's report.

In terms of investor groups, the index for conduits was at 2. It is the seventh straight quarter that the conduit index has been below 20. The conduit index peaked at 606 in the second quarter of 2007. Life insurance companies had the highest reading of entities that loan on commercial real estate coming in with a reading of 69.