Amid an avalanche of pessimistic commercial real estate forecasting, many investors continue to wait for a market bottom before buying distressed notes, properties and securities. Buyers are often grossly undershooting price targets, while sellers are overshooting. And the result has been the stalemate that — combined with the credit crunch — has gripped the industry for the past 15 months.

Rather than continue their elusive search for a market bottom while letting opportunities go by the wayside, investors should consider shifting their focus and identify viable real estate investment strategies tailored to meet their needs.

Seizing the moment

Case in point, Prudential Mortgage Capital launched a $1 billion commercial lending program in February, and since then has deployed about half that capital in its account. Prudential and the other active lenders today have little competition, allowing them to dictate underwriting terms and seize the best lending opportunities available. Such dominance was not possible in the previous real estate up cycle, due to an abundance of competing capital.

Prudential recently stated in its third-quarter earnings report that its return on capital from real estate lending activity is in excess of 7%, a rate of return that is quite superior to the safe bet of the 3.5% return on 10-year U.S. Treasury bonds.

In another case, S.K. Hart Properties based in Newport Beach, Calif. recently bought the Bayview Corporate Center office complex, the former headquarters of failed Downey Savings & Loan. S.K. Hart purchased the asset from the FDIC for $53 million in an all-cash deal.

Totaling about 332,000 sq. ft., the two, six-story towers represent the largest FDIC asset sale to date from its portfolio of failed bank assets. Bayview Corporate Center was only 23% occupied when the deal closed.

These transactions represent distinct real estate investment programs with distinct investment objectives. When other prudent investors find their ideal opportunities, the question of price discovery — which is keeping many buyers on the sidelines — will eventually become an irrelevant one.

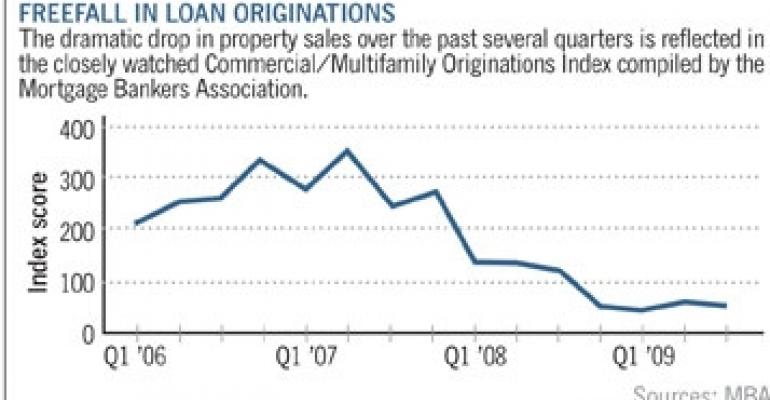

To be sure, property sales and refinancing activity are still occurring, even though the pace has slowed significantly. The Mortgage Bankers Association reports that commercial and multifamily loan originations fell 12% in the third quarter compared with the second quarter. On a year-over-year basis, the drop in the third quarter was a whopping 54%.

But be that as it may, a number of lenders and their loan intermediaries are beginning to announce that more deals are closing, particularly in the small- to mid-cap multifamily and credit-tenant markets.

Unrealistic expectations

Even though forecasts for further deterioration in commercial real estate fundamentals continue unabated, many investors are still in search of returns that are simply not realistic in today’s environment. Private equity funds and their participants have grown accustomed to returns in excess of 40%, with anything less than that viewed as disappointing. This group is among the greatest pool of potential distressed asset buyers, but to date it has spent more time on the sidelines than anything else.

Preqin, a London-based alternative asset investment firm, recently reported that fundraising and investment activity at 46 private equity real estate funds was suspended through the first three quarters of 2009. This number is running well ahead of 2008, when a total of 27 funds were put on hold for the entire year. The company expects this trend to continue well into the fourth quarter, and possibly into 2010.

This trend suggests that because high-yield investors are unable to easily meet their lofty investment objectives in today’s market, they are opting to wait for others to discover a market-clearing price before they will jump in and buy.

The problem with that strategy is most other investors share a similar view. They continue to hold out for a commercial real estate Armageddon — one that has yet to materialize.

Investors like Prudential and S.K. Hart Properties that have realistic expectations in place will reap the benefits of either above-average yields or a lease-up program that they can control. These are by far preferred investment objectives to the all-consuming task of chasing the absolute lowest price.

Joe Caton is a south Florida-based journalist who also provides training and development services to real estate finance and investment professionals.