Real estate owners in the Emerald City have wrestled with rising property tax rates over the past two years. But with assessed values on commercial assets now leveling off and even rising in some cases, next year’s tax bill may really pack a wallop that few landlords anticipate.

What is driving up tax bills for 2012? Three factors are at work:

Commercial values are stabilizing. Nationwide and across property types, commercial property values lost nearly half their value, or 48.9 percent, from the peak in October 2007 to a low in April this year, according to the Moody’s/REAL Commercial Property Price Indices. But that decline may be over for the many commercial assets to receive larger assessed values this year. The Moody’s/REAL national all property types index increased for the fourth consecutive month in August and was up 15.3 percent from April’s post-peak low. T he worst appears to be over in Seattle, as well, and the latest assessed values reflect that.

Residential values are still falling. Assessed values for single family residences-two-thirds of the tax base—appear to be falling again this year. In August, average home values in Seattle had fallen 0.3 percent from the previous month and were down a depressing 6.1 percent from a year earlier, according to the S&P/Case-Shiller Home Price Indices. Statistics recently released by the Northwest Multiple Listing Service suggest an even larger drop in home prices.

Tax rates are rising. As residential values continue to fall, tax rates will likely increase for the third consecutive year. That means higher taxes for commercial property owners whose values have stopped falling.

Legal balancing act

Tax rates cannot be predicted with certainty at this point in the year, so budgeting for 2012 property taxes is difficult. Property owners should plan to revisit budgeted tax expense in late January, when the final tax rates are published. Tax bills will be mailed on Valentine’s Day or soon thereafter.

The interplay of two property tax limitations under Washington’s state law increases the complexity of predicting next year’s taxes. These limitations are commonly known as the 1 percent limit and the 101 percent limit.

The 101 percent limit provides that taxing districts may not increase their total tax collections by more than 1 percent from the preceding year. This doesn’t directly limit tax increases on individual properties, and as always there are exceptions. The primary exceptions are new construction and voter-approved tax increases.

The 1 percent limit applies to tax rates. With certain exceptions, again including voter-approved taxes, the sum of all the taxing districts’ tax rates cannot exceed 1 percent.

When real estate values were increasing rapidly several years ago, the 101 percent limit had the effect of driving down tax rates. This created headroom under the 1 percent limit so that tax rates could rise when values fell.

Seattle experience

The appraisers at the King County Department of Assessments attempt to follow the market, both up and down, in their annual assessments. The pattern of value changes in recent tax years reflects the market downturn, albeit with a bit of a lag: Real property assessments climbed approximately 14 percent from the previous year in both 2008 and 2009, plummeted over 12 percent in 2010 and fell another 3.5 percent in 2011.

These percentages are imperfect for tax-planning purposes because they reflect both new construction and changes in market value for existing properties, but they show the general direction and magnitude of the assessed value changes.

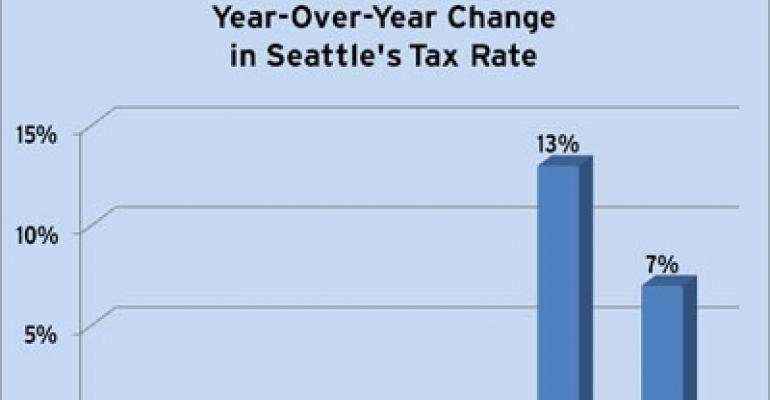

Because of the two tax limitations described above, property tax rates move in the opposite direction of assessed values. Throughout the Seattle area, tax rate increases in 2010 and 2011 offset the value decreases for most commercial property types.

The big unknown is the 2012 tax rates. The taxing districts are allowed to raise their tax collections to 101 percent of the preceding year, if they have sufficient headroom under the 1 percent limit on the combined tax rate. Many taxing districts, and perhaps most, can be expected to raise their tax rates. How much the tax rates go up will depend on how far single-family residential values have fallen and how much headroom remains.

Many commercial property owners will no longer have a substantial decrease in value to soften the blow of higher tax rates. In fact, for those property types that saw significant value increases this year, such as hotels, the increased values will amplify the effect of increased tax rates.

Seattle commercial property owners who have taken a casual approach to estimating 2012 property taxes may be in for an unpleasant surprise when tax bills arrive in mid-February. Now is the time to take another look at those 2011 value notices and reconsider the logic behind 2012 tax budgets.

If in January the published tax rates indicate that budget revisions are in order, prepared taxpayers can adjust budgets or move to the front of the line with a tax appeal. The alternative is to wait for the tax collector’s Valentine’s Day greeting.

Norman J. Bruns is a partner in the Seattle office of Garvey Schubert Barer, the Idaho, Oregon and Washington member of American Property Tax Counsel.