Long a go-to for corporate cost cutting, corporate real estate has turned a corner and is becoming a solid productivity driver, with CEOs starting to reap the rewards of enhanced revenue, shareholder value and employee performance. A new Jones Lang LaSalle (JLL) report reveals that companies that view real estate assets singularly as a source of short-term cost reduction are actually incurring hidden long-term financial and operational risks.

JLL’s second biennial report on Global Corporate Real Estate Trends unearths the five top corporate real estate risks, including possible negative impacts to competitive advantage and profitability from cost cutting, procurement processes, lack of collaboration between functions and failure to drive productivity.

The 2013 survey, which measures insights from more than 630 corporate real estate executives in 39 countries, points to the prodigious pressure corporate real estate decision-makers are under as 68 percent of respondents recognize increasing demand from senior business leaders to enhance productivity of the real estate portfolio.

“The global financial crisis moved real estate up in importance to CEOs as a tangible lever for enhancing revenue growth. Our survey shows that more CEOs today are realizing that, by investing in long-term, revenue-focused corporate real estate strategies, they can best leverage their real estate assets to mitigate risks and increase long-term profitability,” said John Forrest, Global Director and CEO of Jones Lang LaSalle’s Corporate Solutions business in Asia Pacific. “While short-term cost cutting is tempting, sustainable financial and operational benefits are more often achieved when cost reduction and revenue-enhancing investments are considered together.”

JLL addresses the outcomes of these increased pressures in its Global Corporate Real Estate Trends report, which details the top five risks and rewards corporate real estate users are facing in 2013:

- Singular focus on real estate cost cutting undermines potential rewards from revenue-enhancinginvestments

- Procurement drives price- rather than value-driven outsourcing partnerships

- Workplace productivity is frequently miscalculated in cost-per-square-foot terms, whencontribution to business performance better characterizes returns

- Collaboration with HR, IT and Finance is a must for enhancing workplaces, yet silos continueto constrain joint efforts

- Compromising real estate quality to enter high-growth global markets is dangerous

To see how these five risks are impacting the future of corporate real estate, view an interactive video and read the summaries below.

Risk One: Singular focus on real estate cost cutting undermines potential rewards from revenue-enhancing investments

Investments in long-term real estate and workplace strategies are many times rewarded with significant contributions to productivity and corporate performance; however, the increasing pressures on real estate teams to implement short-term cost cutting continues to undercut more strategic moves. Real estate can continue to add productivity value when cost-cutting measures have run their course – but typically requires

|

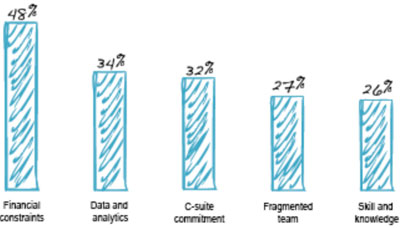

Figure 1: Constraints hindering corporate real estate from enhancing its strategic position. Source: JLL 2013 Global Corporate Real Estate Trends |

investment, and the resulting corporate resistance to capital expenditure is a difficult barrier to hurdle. JLL’s survey reveals that 48 percent of corporate executives view financial constraints as their greatest limitation to adding more strategic value to their businesses, while 34 percent also cite lack of effective data and analytics (see Figure 1). Many lack the tools and training to effectively identify, shape and execute the broader business strategies that would ultimately deliver the most business impact. Corporations need to recalibrate their real estate functions away from tactical cuts and into strategic investments.

Risk Two: Procurement drives price- rather than value-driven outsourcing partnerships

Corporate real estate outsourcing is developing rapidly, and its reward can be significant contributions to real estate productivity, innovation and efficiency. In fact, 92 percent of companies surveyed in JLL’s report are practicing some form of real estate outsourcing. With this rise comes increased participation from the procurement function in the choice of outsourced service providers, with 68 percent citing active involvement. Yet, 58 percent report that procurement, when involved, has a limited knowledge of real estate and its complexity and could overlook these characteristics in a price-driven procurement process.

Risk Three: Workplace productivity is frequently miscalculated in cost-per-square-foot terms, when contribution to business performance better characterizes returns

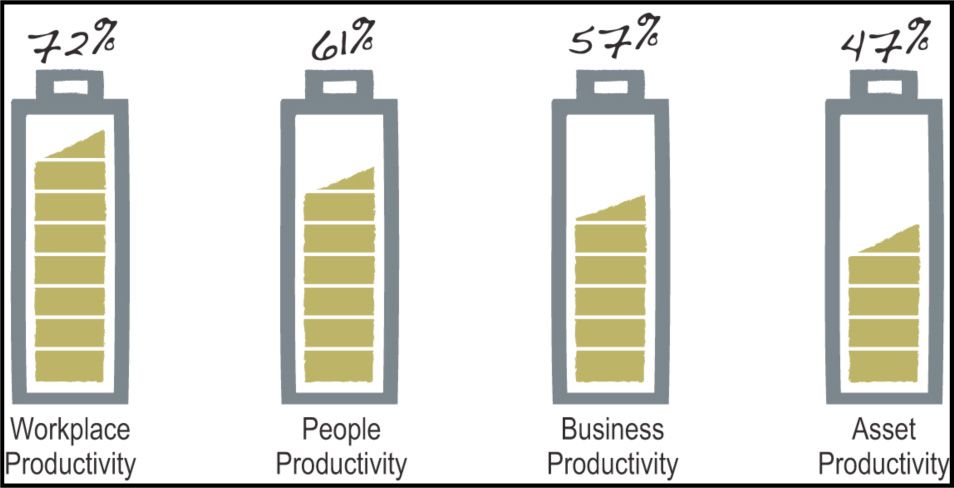

Many corporate real estate footprints are shrinking. However, achieving greater density is not the same as achieving productivity, which at least 90 percent of respondents are charged with doing. According to JLL’s report, this unwieldy corporate expectation is prevalent as 74 percent of companies now expect real estate to drive workplace productivity. Additionally, 61 percent look for people productivity, 57 percent demand business productivity and 47 percent cite asset performance as a key value driver for the company (Figure 2).

| Figure 2: Company expectations on productivity outcomes expected from commercial real estate. Source: JLL 2013 Global Corporate Real Estate Trends |

|

Corporate real estate is more about people than property, and workplace strategy should be centered on how to use property to make employees more productive. The good news is that 67 percent maintain that they’re making strides as the quality of their workplace has improved during the last three years, demonstrating a focus on quality over pure space utilization metrics. At the same time, this quality has been achieved alongside efficiency, with 68 percent suggesting that the utilization of space has also improved. Metrics that will help to mitigate this risk include calculating new workplace environments and the achievement of business goals, sales increases that follow real estate strategy execution or other performance metrics that directly or indirectly link environmental improvements, relocations or capital investments to business outcomes.

Risk Four: Collaboration with HR, IT and finance is a must for enhancing workplaces, yet silos continue to constrain joint efforts

Achieving the reward of true workplace transformation requires collaboration, changing management styles and true cross-functional alignment. Formal collaborative organizational structures, such as administration or shared service centers, are likely to increase as workplace productivity increases in importance as a strategic focus. This change presents an opportunity for corporate real estate teams to play a leadership role with partners in HR, IT and finance, and that collaboration trend is forecasted to shift commercial real estate into an integrated shared service in the next three years. While only eight percent of respondents indicated that their function is currently contained within a cross-functional group, 51 percent identify with the model of shared services integration with finance. The reward for such leadership can be improved worker, workplace and real estate portfolio productivity.

Risk Five: Compromising real estate quality to enter high-growth global markets is dangerous

Portfolio growth is predicted to be strongest in the world’s emerging real estate markets that also tend to operate fundamentally differently than mature markets well-known to the executive suite. Many of the emerging markets with the highest growth potential operate with less transparency compared to mature markets, so the process of securing space requires a culturally-sensitive approach and local empowerment in order to seize opportunities that best support business growth.

Nearly one in five respondents recognizes that the greatest challenge facing corporate real estate executives is the risk of not being able to support business expansion in high-growth, low-transparency markets. The possibility of missed expectations is high and failure to deliver can damage the company’s reputation and standing of its real estate team.

“Companies that secure the right real estate in low-transparency, high-growth markets will be well-positioned to take advantage of global economic expansion where it is the strongest,” said Dr. Lee Elliott, JLL’s Research Director for the firm’s EMEA region. “Our research indicates that the time and resources invested in fully understanding the local real estate dynamics in those markets carries the potential to achieve significant corporate returns. Commercial real estate teams must educate their business leaders about the practicalities of building platforms in emerging markets if their reputations are ultimately to be maintained or enhanced.”

Wondering where your corporation stands?Find out how your organization measures up to its peers in key areas such as outsourcing plans, workplace strategy and resource capacity. Answer five quick questions via JLL’s interactive online tool and receive an instant comparison of your responses with the survey result norms.

To request a full copy of the report, visit www.jll.com/globalCREtrends or download a presentation on JLL’s new Slideshare profile. Social media users can also engage in the conversation about the future of corporate real estate on Twitter using #CRETrends.

A leader in the real estate outsourcing field, Jones Lang LaSalle’s Corporate Solutions business helps corporations improve productivity in the cost, efficiency and performance of their national, regional or global real estate portfolios by creating outsourcing partnerships to manage and execute a range of corporate real estate services. This service delivery capability helps corporations improve business performance, particularly as companies turn to the outsourcing of their real estate activity as a way to manage expenses and enhance profitability.