The order takers have long vanished and so has the easy money. An epic slowdown in transaction volume and leasing is forcing commercial real estate brokers to work harder while earning less than in recent years, but market veterans say now is the time to prepare for the next growth cycle.

“I’m laying the groundwork to be prepared whenever things start to sell again,” says Helen Jobes, senior investment advisor in the Austin office of brokerage Sperry Van Ness/Gold Eagle Investments. “I’m educating my clients and I’m reading everything I possibly can on the market, any economic notices or FDIC announcements.”

No office buildings larger than 30,000 sq. ft. sold in the first half of 2009 in Austin, according to Jobes, who publishes her own reports on the local market. Jobes brokered a $5 million office sale in Houston earlier this year and has closed some leases and owner-occupied acquisitions, but those deals have been few and far between.

In the meantime, Jobes is applying to the Women’s Business Enterprise National Council to certify her office as a woman-owned business, a designation she believes will help her win property listings from businesses and agencies that give preference to women-owned firms. To ensure that she is prepared to market those listings effectively, Jobes is tracking Texas properties that are likely to be foreclosed upon by lenders. “And I’m talking to all the bankers I know, making sure they know my expertise and how I can help them.”

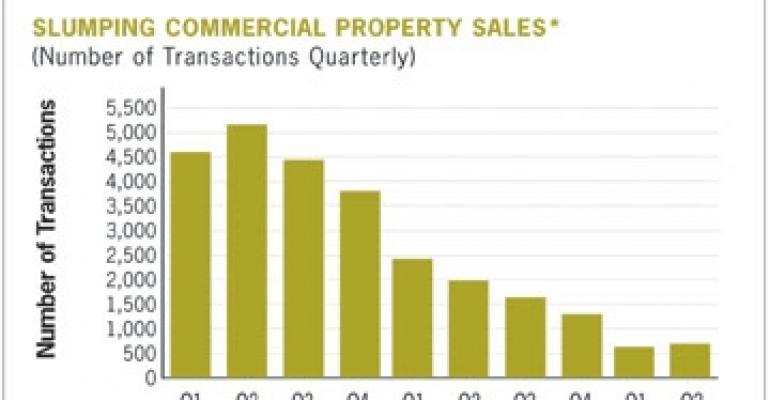

Across the nation, brokers are looking for productive ways to use their time while transactions are at a near standstill. The number of commercial real estate deals closing today is a fraction compared with volume in the years leading up to the market peak in October 2007.

Just 650 commercial properties in the United States sold for $5 million or more in the second quarter this year, a 33% drop compared with the same period a year ago, according to Real Capital Analytics.

“Brokers are having a nice, long summer holiday this year,” quips Dan Fasulo, managing director at the New York-based research firm. Humor aside, Fasulo says that brokers seem to be growing busier this summer as property owners seek marketing proposals for assets they plan to sell.

Recent offerings in New York and other cities have drawn as many as 40 bids, he says, a sign that investors are still interested in acquiring commercial real estate. “It’s a pretty safe bet at this point that we’re going to see transaction activity pick up in the fall,” he says.

Brokers must work even harder in a down market to generate commissions, according to Gene Berman, senior vice president and managing director in the Fort Lauderdale office of Marcus & Millichap. “Our brokers know that to earn 50% of what they earned in 2005, they have to double their efforts in 2009,” he says.

During the buying frenzy two years ago, brokers spent their working hours fulfilling orders from investor clients who were lined up to buy or sell real estate, says Berman, who oversees his company’s brokerage activity in Florida and Texas. But in today’s troubled commercial real estate market, exacerbated by a credit crunch and falling asset values, brokers need heightened skills to close a deal.

The best brokers today are adept at managing client expectations by educating sellers on the prices private investors are willing and able to pay for commercial real estate. “As brokers, we reflect the market,” Berman says. “We can’t make the market, meaning that we can’t get sellers to do something that they don’t want to do.”

Once a client understands current pricing trends, brokers can help them form a strategy. The plans that Marcus & Millichap have prepared for clients this year fall into one of three buckets: conventional, strategic or distress.

Conventional proposals guide a private party in making the most of their equity in a commercial asset. Strategic proposals map out a course of action based on what is likely to happen in the next six to 18 months, while distress proposals help clients who are lenders plan how they will handle their foreclosed — or soon-to-be foreclosed — real estate.

What deals are Marcus & Millichap brokers closing? Smaller deals are less complicated to arrange than large transactions, Berman says. More importantly, the local banks that are an important source of financing today are better able to fund small acquisitions or refinancings than large ones.

By property type, agency financing gives multifamily deals a better chance of closing than other property types, while office or retail projects occupied by a single, high-credit tenant are also more often successful obtaining transaction financing.

No deals are easy in 2009, but brokers who face and overcome challenges to transact business today will have stronger skills to offer in the years to come, Berman says. “Having been through this before, agents who see it as an opportunity to grow their skills and to create strategic alliances with all three types of clients are going to do well.”