Multifamily investors holding commercial mortgage-backed securities (CMBS) face more near-term pain as the volume of apartment loans in distress continues to climb and significant appraisal reductions exacerbate the situation.

The volume of delinquent loans 30 days or more past due soared by $3.5 billion in March over the prior month, according to Trepp LLC, a New York-based commercial real estate data and analytics firm. About $3 billion of that increase was the result of a loan default by Tishman Speyer and BlackRock Realty on Stuyvesant Town and Peter Cooper Village in New York.

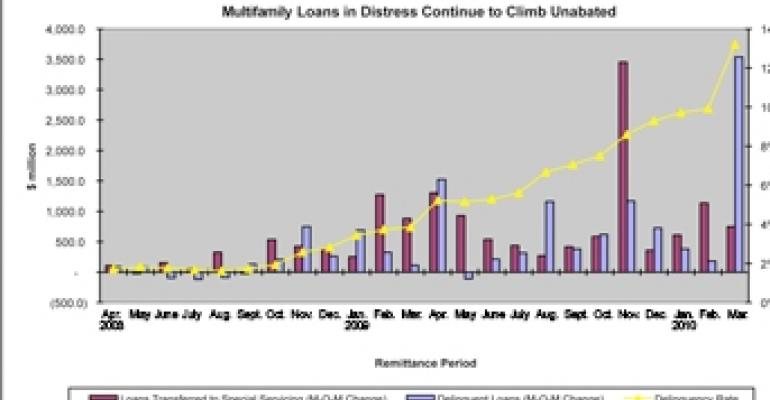

In another sign that many apartment owners are experiencing cash-flow problems, the volume of apartment loans transferred to special servicing rose by $747.9 million in March over February levels. At the end of March, the delinquency rate on CMBS multifamily loans stood at 13.2%, up from 3.9% only one year earlier [See chart].

“In only two of the last 24 months has the month-over-month change in loan volume transferred to special servicing or placed on the watch list seen a net outflow,” says Paul Mancuso, a vice president with Trepp. “Looking forward, we expect the trend in delinquencies to continue its upward path, albeit at a more moderate pace.”

Nearly one-quarter of CMBS multifamily loans are either in special servicing or on a watch list, indicating more potential trouble on the horizon, adds Mancuso. Those troubled loans account for $23.8 billion of the $109.9 billion CMBS multifamily sector. That figure includes $3.4 billion in loans that are in special servicing but performing, and $20.4 billion in loans on the watch list.

Wave of appraisal reductions

A significant drop in property values is compounding an already difficult situation for many multifamily investors. During the first quarter, 164 CMBS multifamily loans experienced a first-time appraisal reduction, according to Trepp. Based on a combined loan balance of approximately $2.2 billion, the total appraisal reduction on those 164 properties was $713.3 million, resulting in an implied loss of 32.3% [See table].

“Many loans that experience an appraisal reduction see those haircuts bumped up the longer the loan has been with the special servicer,” according to Mancuso. During the first quarter, 135 CMBS multifamily loans received an additional appraisal reduction. Based on a combined loan balance of $2 billion, the total appraisal reduction on those 135 properties was $861 million, resulting in an implied loss of 43%.

The first-time appraisal reduction for the New York City Apartment Portfolio Roll-Up, a loan backed by 37 high-rise buildings, underscores the challenges investors and special servicers face. The loan has been in special servicing since September 2008 and is in foreclosure, according to Trepp.

The loan balance on the portfolio as of March 2010 was $195 million, but the most recent appraisal in December 2009 was $129 million. The original appraisal was $321.2 million at the time the loan was securitized in March 2007 during the boom time for the market. In other words, the portfolio has lost 60% of its value.

“If this property is only appraised at $129 million, but the loan balance is $195 million, this loan is way under water,” says Mancuso. “If this loan ever does get resolved, will you really recover the full value of the $195 million?”

The financial hardship endured by some multifamily owners in New York stems from a miscalculation on their part that they could successfully convert rent-stabilized units to market-rate apartments. Stuyvesant Town and Peter Cooper Village is the best example of that misstep.

“The expectation of converting from rent-stabilized units to market rents is a complicated business strategy that just never materialized, whether it was for political issues or strong community opposition,” says Mancuso. “Those were the driving factors that impacted the delinquency rate.”