Alarm bells are sounding across the apartment industry. The delinquency rate on multifamily loans structured as commercial mortgage-backed securities (CMBS) has climbed sharply, rising from 2.4% in January to 5.5% in October. Meanwhile, the fallout over the credit crunch and real estate downturn is wreaking havoc on some big players.

The decision by Fairfield Residential LLC to file for Chapter 11 bankruptcy protection on Dec. 13 is the latest blow to the property sector. One of the largest owners and managers of apartment communities in the country, San Diego-based Fairfield was forced into bankruptcy after it was unable to refinance debt or sell investment properties.

In its filing, Fairfield listed $958 million in assets and $834.9 million in debt at the end of September. It also noted that many of its properties are worth less than the amount owed to lenders.

According to the National Multi Housing Council’s 2009 list of the nation’s top 50 apartment owners and managers, Fairfield ranks as the 17th largest owner with ownership interests in nearly 55,000 units. It also ranked as the 11th largest apartment manager with approximately 60,000 units under management.

Not all gloom and doom

Amid the growing sea of distress in the multifamily sector, prices are actually rising for the highest-quality properties in desirable markets due to a limited inventory of available product.

“It’s really the tale of two markets,” says Hessam Nadji, managing director of research for Marcus & Millichap Real Estate Investment Services based in Encino, Calif. “If you bring any quality property to a primary market that is somewhat supply-constrained, you can count on multiple bids.”

Over the last three to four months, Marcus & Millichap has closed on several deals that attracted 25 to 35 buyers and more than 20 offers. The average capitalization rate (the initial return to the buyer based on the purchase price) has fallen 50 to 75 basis points during that period.

Matthew Lawton, an executive managing director in the Chicago office of HFF, a publicly traded financial intermediary, says that he observes a slight pricing bubble in the market because of a supply and demand imbalance.

“There is a tremendous amount of capital out there. High-net-worth individuals, private capital, and country club-type equity are pursuing assets and opportunities,” says Lawton.

Following the commercial real estate market’s peak in August 2007, cap rates widened 200 basis points across the board, Lawton says. More specifically, cap rates on Class-A multifamily properties ballooned from 5% to 7%, while cap rates on quality assets in secondary and tertiary markets that had once ranged from 6% to 6.5% widened to between 8% and 8.5%.

“I would say that was an overcorrection. Now the pendulum has swung the other way,” says Lawton. Over the past 90 to 120 days, he has watched cap rates for core and trophy assets contract anywhere from 50 to 100 basis points.

Currently, the national apartment vacancy rate is 7.8%, according to New York-based researcher Reis, and that figure is expected to rise above 8% in 2010. But a dearth of new construction combined with the prospects for job growth in the latter half of 2010 should benefit the sector. In addition, higher inflation due to massive government stimulus will have a positive impact on net operating income in the long run, Lawton points out. “A lot of people are looking at potential rent spikes in 2012.”

Red flags

The positive trend in the pricing of trophy properties, however, has been overshadowed by the weak performance of Class-B and C properties in secondary or tertiary markets, or properties in non-core locations or less desirable submarkets within larger metropolitan statistical areas (MSAs).

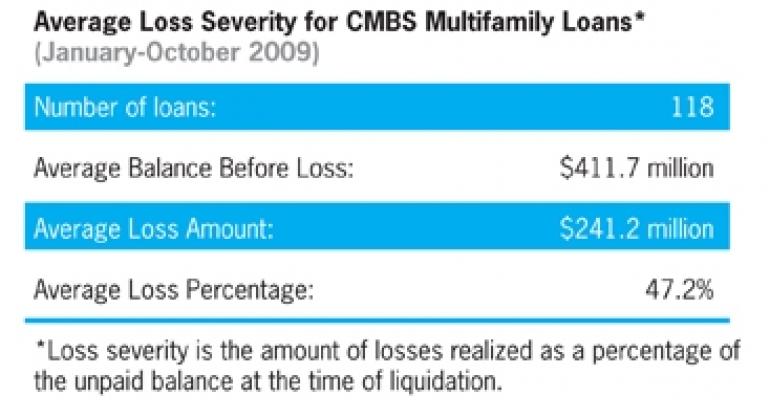

CMBS loan delinquencies on multifamily properties rose from a miniscule $903 million in July 2007 to nearly $8.9 billion in October 2009 on a trailing 12-month basis, according to Realpoint LLC, which has been tracking CMBS delinquency trends since 2001.

As recent as November 2008, the multifamily loan delinquency rate was 1.9%, and now it’s 5.5%, according to Realpoint, which considers a loan to be delinquent when it is 30 days or more past due.

What led to the sharp uptick in delinquencies? Frank Innaurato, managing director of CMBS analytical services at Realpoint based in Horsham, Pa., says many of today’s CMBS woes can be traced to an overheated property market that was on tread mill from 2005 through early 2008, when owners acquired a large number of “older vintage acquisitions.”

The strategy among many owners and investors, he says, was to complete upgrades, such as installing new carpeting and appliances, and boost rents anywhere from $100 to $200 per unit, depending on the property or location.

“Many of the defaults of multifamily CMBS loans have occurred in some of these cases where such projects failed,” says Innaurato. The other pitfall that owners fell into was to simply take on too much debt, leaving them no cushion in the event of a downturn.

Currently one of the most high profile, troubled multifamily developments is the Stuyvesant Town and Peter Cooper Village development in Manhattan. Tishman Speyer Properties and BlackRock Realty Advisors paid $5.4 billion in 2006 for the pair of gigantic Manhattan apartment complexes.

The strategy was to convert thousands of rent-regulated apartments into luxury units that would command top dollar. But that conversion process was effectively halted when the matter became tied up in litigation.

Although the $3 billion securitized loan on Stuyvesant Town and Peter Cooper Village is in the hands of the special servicer, the owner has not defaulted on the loan. “The multifamily delinquency rate can clearly be affected in one month by whether or not Tishman continues making payments on the Peter Cooper Village loan,” says Innaurato

More ripple effects

The good news is that CMBS loans accounted for only 12% of the $914.3 billion in total multifamily mortgage debt outstanding in the second quarter of 2009, according to the Mortgage Bankers Association. By comparison, government-sponsored enterprises Fannie Mae and Freddie Mac accounted for a 38% market share while commercial banks had a 24% piece of the multifamily debt pie.

A large chunk of the newly delinquent CMBS loans are concentrated in a few states, including Texas ($385.4 million), Florida ($230.7 million), Maryland ($191.5 million) and New York ($180.2 million), according to Marcus & Millichap and Trepp LLC.

Texas simply got overbuilt during the boom while Florida has been plagued by incomplete construction projects in the wake of the condo and single-family housing bust.

There is still likely to be another lending shoe to drop, says Nadji. “Unfortunately, the bad news is that a lot of the [troubled] condo conversions and local construction projects — the mid-sized projects — were financed by local and regional banks,” he says. “So, not only do we have problems concentrated heavily in he CMBS market, right behind that we’re going to see some trouble in the bank portfolios.”

Seizing the opportunity

Gables Residential, a luxury apartment developer that owns 16,000 units and fee manages another 25,000, seeks to take advantage of the fallout in the multifamily sector.

“We’re looking to acquire assets that are distressed in some way,” says Joe Wilber, senior vice president of investments for Gables Residential. “Perhaps the construction on a project has not been completed.” Or, Wilber adds, a developer may be struggling to financially stabilize an asset. In either case, Gables Residential can come to the rescue, if it makes strategic sense

The company also is generating new business by managing properties for banks and receivers who have taken back troubled assets. The company’s long track record as a successful property manager certainly helps.

That’s not to say Gables Residential is immune to the sharp downturn in the economy. At the conclusion of the third quarter, the company’s portfolio-wide occupancy rate was a relatively healthy 93.3%. But its net operating income dropped 3.7% in the third quarter of 2009 compared with the same period a year ago.

“We’ve been able to maintain the occupancy rate, but you do that at the expense of revenue. You lower your rates to where you keep your buildings full,” says Wilber, who is based in the firm’s Atlanta office.

A large owner, Gables Residential is active in seven markets: Atlanta, Dallas, Houston, Austin, South Florida, South California, and Washington, D.C. Atlanta accounts for 20% of its portfolio.

Wilber says that a downturn in the apartment industry had been expected, but the depth of the recession has knocked most everyone affiliated with the property sector for a loop.

“We have been hit by a double whammy,” emphasizes Wilber. “We lost a lot of our residents to home ownership [before the recession]. You combine that with the job loss situation and the oversupply of our product, and it’s not too surprising.”

But he is quick to add that rent growth in 2011 and 2012 could be significant because the apartment development pipeline has slowed to a virtual standstill. He also anticipates pent-up demand among renters once the job market improves.

“The beauty of our product type is that our leases are short term, generally one year or less,” concludes Wilber. “As the market recovers, our product type will recover quickly. We’re not tied down to long-term leases that you would experience in the commercial or retail sector of real estate.”